I've actually traded with multiple Forex brokers in this list. Most importantly, these brokers are regulated with atleast one of these regulation; FCA (UK), CySEC & FSCA.

In 7 years of my experience as a forex trader, I’ve opened account & traded with multiple different brokers, including both foreign regulated brokers & offshore brokers.

One thing I’ve noticed is that there are lot more scam brokers operating in Nigeria than genuine ones. But I’m not going to name them here, that is not the purpose of this resource. But just look at their regulations & you will know who I’m talking about.

I’ll tell you straightforward that most brokers I’ve used had similar platforms, all mostly offered MetaTrader. There is only one that is not Metatrader based broker.

In this list I’ve listed the brokers which I’ve used myself. But I’ll add a disclaimer that I’ve not used all these brokers, I’ve still listed them because they are regulated with one major regulator. This factor is important to me.

Best Forex brokers in Nigeria

I look at various aspects in order to to assess each broker, these include the broker’s compliance with multiple Top-tier regulations, broker reviews, the amount of fees charged (spreads, commissions & even the hidden charges), leverage offered, minimum deposit, funding & withdrawal methods and time taken etc.

In the beginning of my trading, I did not exactly consider all the factors, but as I’ve traded more there are factors that I’ve found to be more important.

The below vetted list is created especially for Nigerian traders, others could also find it useful (I’ve traded with Exness, HFM & XM mostly); so it will quickly allow you to compare the key features including spread, leverage, regulation & other factors that you must look for in any reputed forex broker.

I try to update this list from time to time as I find new features that become more important to me in a broker as I trade more.

Here’s the updated list of the forex brokers I’ve found to be good in Nigeria. Quick Note: For me I’ve mainly looked at their rading & non-trading fees, promptness of deposits & withdrawals, trade execution, support & deposit bonus (in the last 6 months, some promotions may not be valid today for the reason that I did not make a recent deposit with that broker):

Ranks #1 Forex broker in Nigeria

I’ve traded with Exness the most out of any other brokers in this list. Right now I use Exness for most of my trading on currencies. But I don’t use Exness for trading indices.

Exness’s parent is a regulated broker in UK & EU. They offer market Execution (but it is very fast), very competitive spreads of as low as 0.3 pips for EUR/USD (with Pro Account) & other pairs, $1 minimum deposit, multiple deposit options & fast withdrawals; it also offers local bank deposit in Nigeria. I recommend Exness if you want to trade with tight spreads, but there are many downsides to them as well

As per the data I’ve researched on the internet, Exness is one of the largest broker in terms of monthly trading volume. They are regulated in UK by Financial Conduct Authority (FCA) under license number 730729, the CySEC with license number 178/12 & with FSCA in South Africa.

Exness has a wide range of trading instruments to choose from with more than 100+ Major, minor & exotic currency pairs. This is quite wide compared to other brokers. Further, with Exness you can trade on the advanced MetaTrader 5 platform that even has a news feed.

But I’m still using their MT4 platform. I’ve not used any other platform. You can trade all the major instruments from their MT4, it is easy. But what I would add is that although they offer other instruments, I use it only for currency trading. I don’t like their fees on other instruments.

If you are only trading forex, I like the tight spreads at Exness. You can get 0.6 pips spread on Pro Account on an average. This is very comparable to what they have listed on their website, so you can say that with other accounts as also, you would get spreads that they claim to offer.

Exness has local bank transfer option for funding & withdraws in Nigeria. This payment method is instant even during withdrawals. But your balance will be converted into Naira during withdrawals & USD (or your chosen account currency) during funding, at the latest exchange rates. Exness does not offer Naira base currency account at the moment.

The minimum deposit at Exness via online bank transfer is USD 10, and their are no extra fees for funding or withdrawals. Another key feature is that withdrawals via some methods is executed instantly upon request.

I don’t really like their customer support too much, for me it is hit or miss. Some times they are very fast, but some times you just have to wait for days. I’ve only talked to their English support.

The email support is slow to respond to queries. There is a long hold time on their Live chat (most of the times), and normally you have to wait for a few minutes before connecting with their live chat agent.

Their support is one of the biggest downside for me, but their overall fees is low.

Exness Pros

Exness Cons

Ranks #2 Forex broker in Nigeria

HF Markets (formerly HotForex) is another forex broker which I’ve used. I don’t use them now (because I find it easier to trade forex on Exness MT4 than to shift between brokers), but I’d still recommend them to you if you are a new trader.

They have a local office & phone support in Nigeria & are a highly regulated broker (FCA, FSCA & CySEC). They are a 100% STP broker which ensures very fair dealing. Plus they offer very good order execution on all trades, have low spreads for EUR/USD & other majors, and very good customer support as well. I recommend HFM to beginner traders (if you are new & need to trade on simple no commission accounts). HFM is well regulated, but most importantly they have low cost accounts.

HFM was established in the year 2010. They are regulated with FCA (UK), CySec & even Financial Sector Conduct Authority (South Africa), so I found them to be a trusted broker for Nigerians. Many of my trader friends still use HFM.

They have very low minimum deposit, as low as $5. Also, they offer extremely competitive spread of 0.3 pips for EUR/USD with Zero Account (1.3 pips with Premium, Micro Accounts), 0.8 for USD/JPY, 0.6 for GBP/USD (this may vary depending on the market fluctuations). Their typical spread for forex pairs is lower than most other brokers.

The Swap fees at HFM is not that low for most currency pairs. For example, for a major currency pair like GBP/USD, the Swap Fees is -1.1 for Short positions & -4.9 for long positions. This is higher than many other CFD brokers like Exness. So, the overall fees would be higher for positional traders, but it is low if you are an intraday trader.

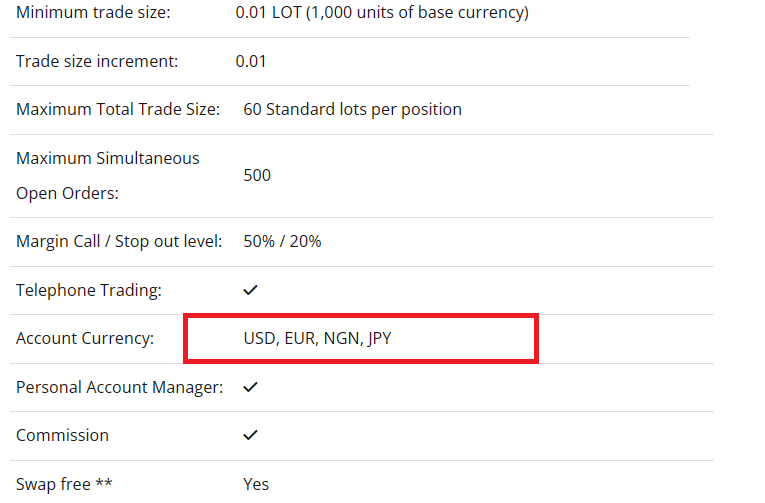

All the trading accounts at HF Markets can be opened with Naira as the Base currency. You can also open account in USD, EUR as the account currency. There is no extra fees for Naira base currency trading accounts.

There are 53 Currencies available for trading on their platforms. There are over 100 CFDs on Metals, Commodities, Energies, Indices, ETFs, Shares, cryptos & Bonds. Overall, the range of trading instruments are wide, but there are higher number of currency pairs available at other brokers like Exness.

Further, HFM offers trading on various platforms that can be accessed from Android, iPhone and desktop. You can trade on the MetaTrader 4 or Metatrader 5 platforms, both of which are the most widely used trading platforms in the world.

HFM also offers local bank withdraw and deposit methods for Nigerian traders, and there are many wallet options as well. There is no extra fees for local deposits & withdrawals in NGN, so any deposits that you make will be credited to your account.

But in this, it is important to know the currency conversion fees at HFM, because this fees will be applied when you are making deposit from Naira to your USD trading account. If you hold a Naira based trading account, then you can ignore this fees, because all your Naira deposits & withdrawals will be in your local currency. But if you account is in USD or EUR for example, then the deposit & withdrawals will be at the exchange rates mentioned during deposit & withdrawals.

Also, HFM have ongoing deposit bonus promotion available for traders in Nigeria. You can avail the bonus for new client accounts during initial deposits. Also, they have some promotions for new deposits by existing clients.

HF Markets Pros

HF Markets Cons

Ranked #3 Forex Broker in Nigeria

Octa (formerly OctaFX) is a MISA regulated forex broker that also accepts Nigerian clients (they are also licensed with FSCA & CySEC). They offer good trading conditions including competitive spread, fixed as well as variable spread MT4 accounts, local Nigerian bank deposit & withdrawal methods, and multiple trading platforms i.e. MT4 & MT5 for mobile, web, and desktop.

Octa is a Forex & CFD broker that was established in 2011. They have 3 account types i.e: OctaTrader, MT4 account & MT5 accounts. All these accounts have floating spreads starting from 0.6 pips, and you can choose the account type depending on the platform you want to choose. All their accounts have good trading conditions with support for Scalping & Hedging.

Their trading instruments on offer are limited though, as Octa offers forex trading on only 35 currency pairs, and CFD trading on metals, energies, indices & cryptocurrencies. But they have competitive spread on their available trading assets, especially for traders who are looking to trade major currency pairs, Gold CFDs and 5 main crypto CFDs against USD (Bitcoin, Ethereum, Ripple, Bitcoin Cash and Litecoin).

They also have NASDAQ 100 CFD & some other major stocks available on their platform.

The typical spread at Octa for EURUSD is 0.6 pips with MT4 Account & there is no extra commission per lot. This fees is lower than the typical spreads at other forex brokers compared. They don’t charge any extra fees for funding & withdrawals.

Their support is also very responsive in handing issues. Their live chat support is available for 7 week days, and email support is available 24/7. They also have WhatsApp text support available. But they don’t have a Nigerian phone number currently.

The funding & withdrawal options at Octa are very wide for Nigerian traders. They offer instant funding via Skrill, Neteller, and quick zero fees funding via bank transfer, or cash, or ATM in their GTBank account. Also they offer BTC funding & withdrawal.

Octa Pros

Octa Cons

Ranks #4 Forex Broker in Nigeria

XM Forex was the first broker Ii opened my trading account with. I did it because I found their ad online, but from what I know now, they are still okay.

I say this because they are regulated, and have spread only accounts, so there are no gimmicks. I traded on their account which is similar to their Ultra Low account now. Their deposit today is very low. But the main downside for me with XM is that they don’t have a local office in Nigeria.

XM Group is a part of “Trading Point of Financial Instruments Ltd” which was established in 2009. They are regulated by CySEC (Trading Point of Financial Instruments Pty Ltd) since 2015, and by the Australian Securities and Investments Commission (ASIC 443670) since 2013.

It is important to note that traders from Nigeria are registered under their offshore regulation i.e. ‘XM Global (FSC)’. But since the broker is regulated under 2 major regulations, so they are considered moderate risk broker for Nigerian traders.

XM broker offers 57 forex currencies, and more than 350 CFD instruments on their platform. They also support CFDs on crypto currency on their platform. Further, the broker offers international live web seminars, free training & education to traders where you can learn about successful forex trading.

XM has three major account types, with very low starting deposit & competitive fees. Their EUR/USD spreads is as low as 0.6 pips with their Ultra Low accounts, which is one of the lowest in the industry. Moreover, they don’t charge any commission on with any of their trading accounts. The funding & withdrawals are free.

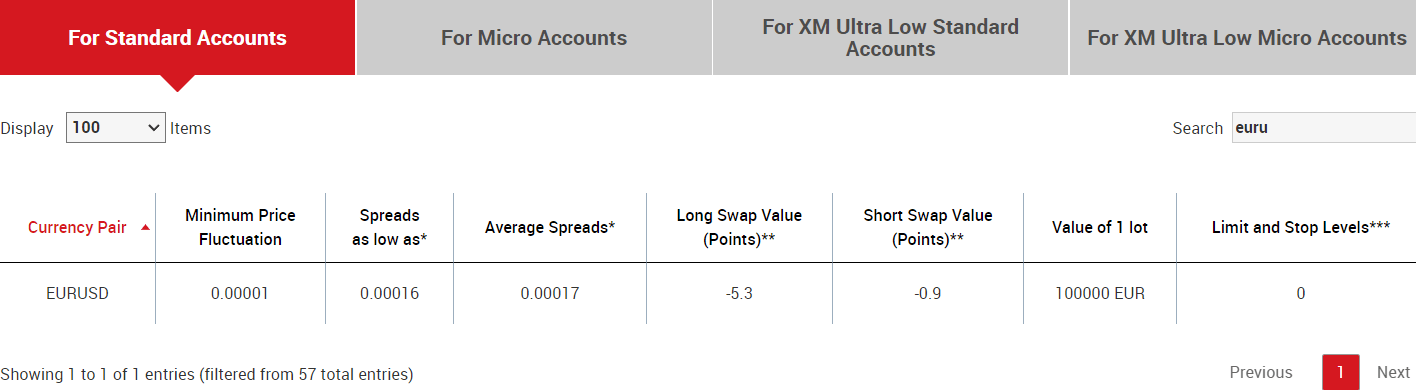

One downside with their fees is their Swap rates. Their Swap fees is higher than most brokers. For example, their Swap for Long EURUSD is -7.74 & 1.26 for short positions.

Another plus is their no re-quotes policy. 99.35% of order with XM are executed in under a second & the company has a strict no re-quotes policy, so instant order execution is guaranteed at XM.

XM broker also offers free research through its own in-house team of analysts. Its interface is quite user-friendly and can be accessed on desktop, mobile, as well as the web.

XM Pros

XM Cons

Ranked #5 Forex Broker in Nigeria

AvaTrade is a well regulated fixed spread European Forex broker. They offer 0.9 pips spread for EUR/USD, and their spread is generally quite low for most instruments. But AvaTrade does not have a local office in Nigeria. They have Nigerian phone number for support, but the phone & English language chat support are not available 24/5, and are only available during their business hours.

AvaTrade does not offer local Online bank transfers for funding & withdrawals in Nigeria. They also do not have NGN base currency accounts.

MT4, MT5 & AvaTradeGO platforms are available for traders. They have local support options available, as they have phone number on their website for traders in Nigeria. But their support is not available 24/7, it is only available during their European business hours. Their support is also available on Whatsapp. But they don’t have a local office in Nigeria.

AvaTrade Pros

AvaTrade Cons

Ranked #6 Forex Broker in Nigeria

FxPro is a UK based forex broker that is FCA regulated & they accept traders based in Nigeria. They support multiple platforms including MetaTrader 4, MT5 & cTrader.

.

FxPro has accounts with floating as well as fixed spreads. The exact fees depends on your account type, which is based on the platforms.

For example, with MT4 market execution model, their typical spreads are 1.43 pips for EUR/USD & it can be as low as 0.50 pips. But with MT4 instant execution account, the typical spreads for EUR/USD, GBP/USD are 1.76 pips & 2.06 pips respectively. Their fees is lowest with cTrader & MT4 Raw+ account types.

FxPro offers CFD trading on range of asset classes. This includes 70 currency pairs, major indices (like DAX, S&P500), stock CFDs, metals, energies & cryptos.

You can deposit & withdraw funds via your card, crypto or bank transfer. The minimum deposit required visa card is $20, and there are no extra charges on deposits or withdrawals.

The customer support at FxPro is good. It is available via live chat, email or call back. But they don’t have a local office in Nigeria. You can request a call bank by fill the form on their website.

FxPro Pros

FxPro Cons

Ranked #7 Forex Broker in Nigeria

IC Markets is an ASIC regulated ECN type broker that offers very Forex trading at very competitive fees. If you are a professional trader that traders in high volume, then Raw spread account at IC Markets is a good option.

It is important to note that traders from Nigeria are registered under their offshore regulation FSA, under the company ‘Raw Trading Ltd’ (License No. SD018). But since IC Markets is well regulated with other Tier-1 regulations, so they are considered a low risk broker.

The total trading fees at IC Markets is low. For example, with their Standard Account, the typical spread for trading EURUSD is 0.62 pips, and it is as low as 0 pips (plus $7/lot total for open & close) with the Raw Spread Account.

By comparison, this trading fees ranges from 0.7 pips on average for major like EUR/USD, which is quite low. Even for GBP/USD, the spread is 0.83 pips on average, so the total trading fees as per my tests is low at IC Markets.

But IC Markets does not accept deposits & withdrawals in Naira. You can deposit in USD & set USD as your account’s base currency.

Ranks #8 Forex Broker in Nigeria

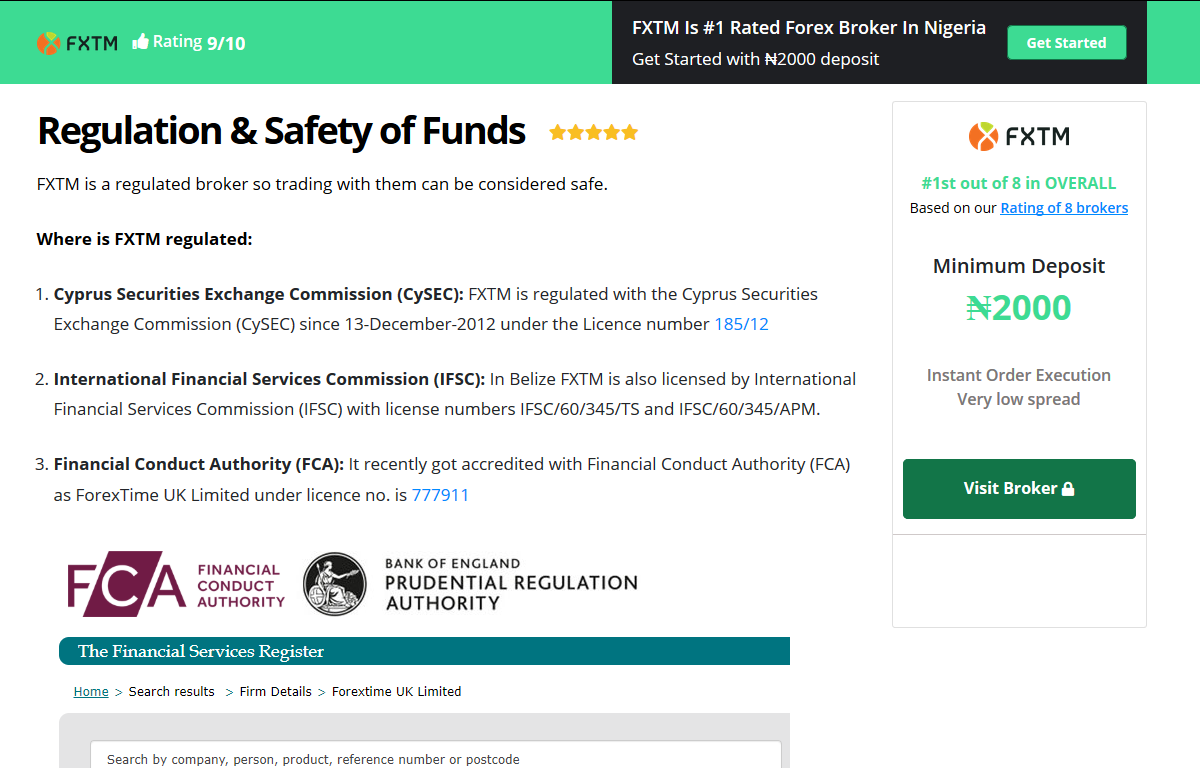

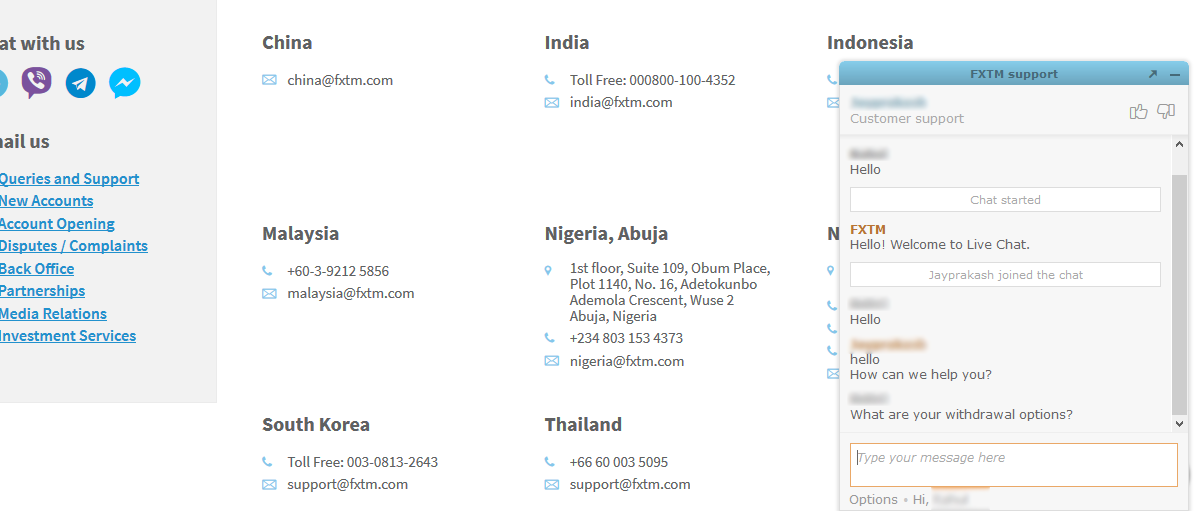

Quick note, I’ve never traded with FXTM, but I’m still listing them because from my research it seems that Forextime or FXTM is a good forex broker, and they are one of the few forex brokers that has local office & phone number in Nigeria.

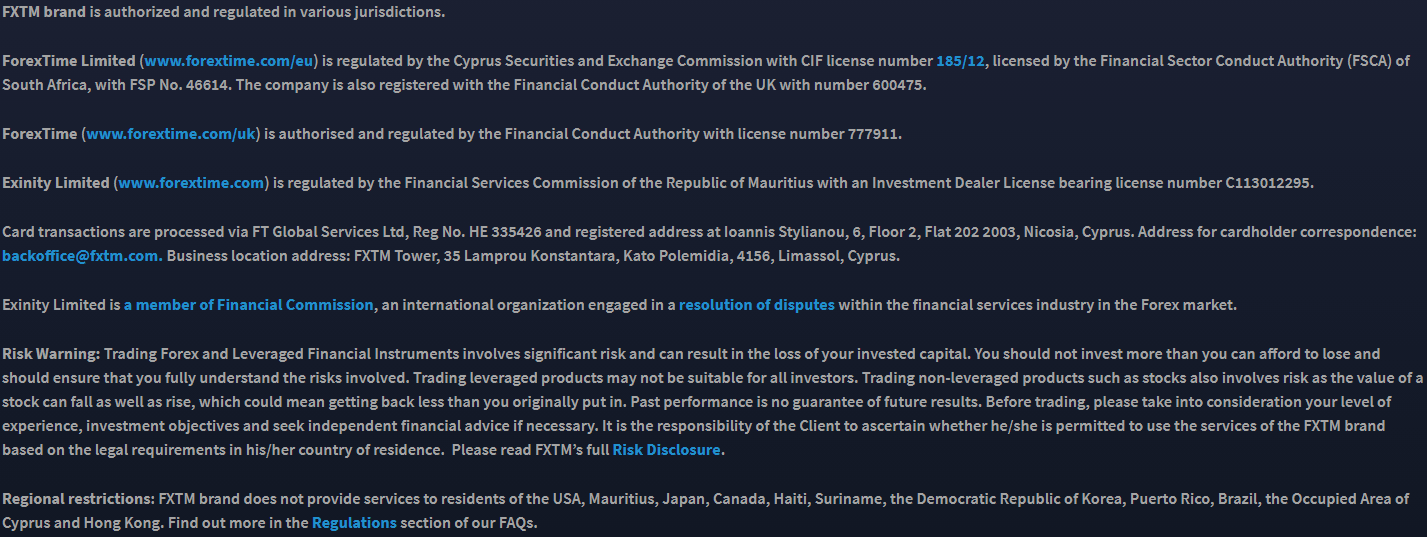

Based on what I’ve searched about this broker, they are safe for Nigerian traders as they are regulated under various trusted jurisdictions such as the FCA in UK, CySEC in Cyprus, FSCA and FSC of Mauritius.

FXTM’s was founded in 2011 & they are a FCA regulated forex broker, which is a Top Tier regulation, so I consider them to be a safe broker. They offer 3 account types, all of them can be funded in USD or Naira & have very low minimum deposit requirements starting from ₦10,000 with the Micro Account. This makes FXTM a very good choice for Nigerian traders.

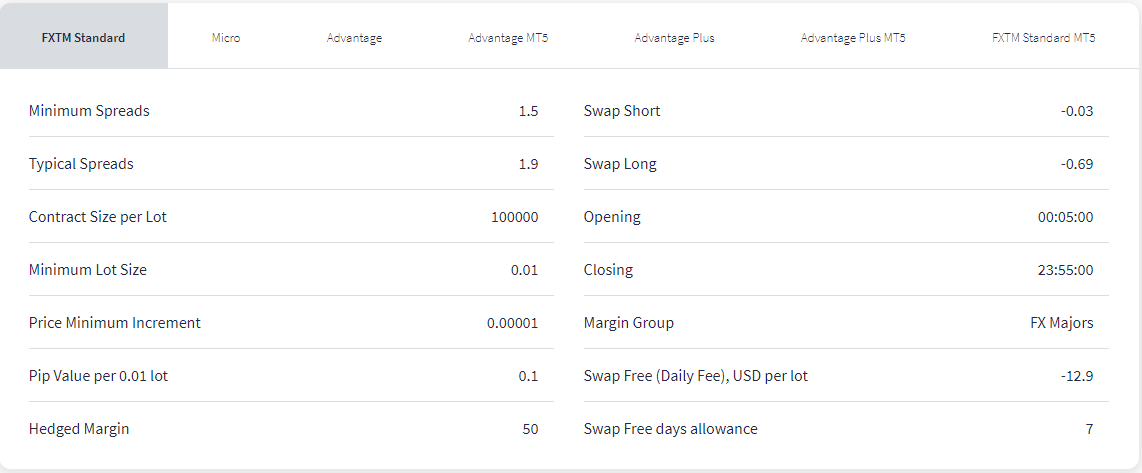

The typical fees depends on your trading account. On average the typical spread for major like EURUSD with the Micro Account is 1.9 pips. This is higher than many other brokers. For lower spread you should choose Advantage account which has a typical spread from 0 pips for major like EURUSD, plus a commission of $4.88 which becomes lower as your trading volume increases.

Their Swap fees are moderate. For major currency pair like EURUSD, the Swap fees is 5.27 for Short & -10.42 for Long positions (as of Jan. 2024). If you have a Swap Free account, then the daily fees is -7.5 per lot for EURUSD with all their account types. This makes their overall trading fees moderate.

Apart from forex trading, FXTM also offer other instruments such as CFDs on Commodity Futures and CFDs on spot metals making them a very attractive choice for traders looking to diversify their trades. They have also recently upgraded its range of currencies & now offer 57 Major & Minor currency pairs. FXTM also has NAS100 instrument available to traders in Nigeria.

I’ve not tested their support individually, but for this review I did talk to their public chat support & they did seem fast. There was no hold time, I was connected immediately, your experience could be different, so please share it with me if you had a different experience.

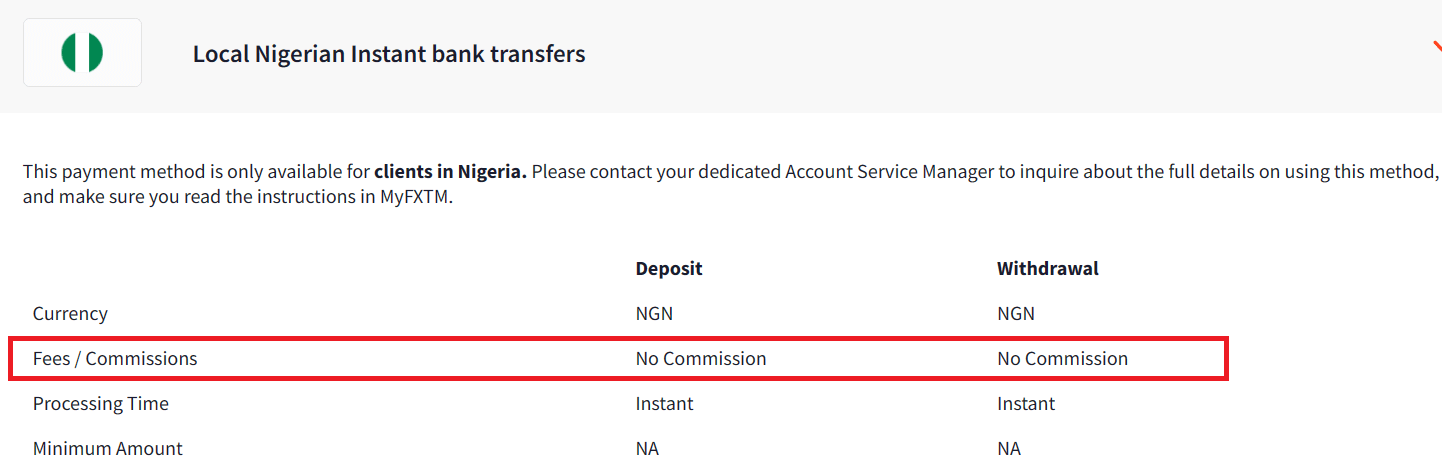

ForexTime has local deposit & withdrawal option available in Nigeria, and you can deposit & withdraw in Naira at zero fees.

FXTM broker has local offices in Lagos & Abuja. They offer English language customer support via Phone, Live Chat & email. FXTM has 19 deposit & withdrawal options which includes many methods for Nigerian traders including Bank Transfer in NGN & Card payment. FXTM allows users to create a demo account in order to build their confidence and learn the art of trading. Plus the also offers a wide range of educational material to its clients, including trading webinars.

FXTM Pros

FXTM Cons

Unlike other review sites, I’ve actually personally traded with most of these brokers. I’ll not recommend any broker I don’t use personally, or did in the past. Or I did diligence on that broker & read online about it.

Even for broker I haven’t traded with (FXTM, Octa, AvaTrade, FxPro & Scope Markets) but are still in this list, I signed up with them to test their actual platforms, support etc.

I’ve give you a suggestion that I follow: When I sign up with any broker, I first start by checking their registration process, any other ‘not so open’ terms & policies that could affect you later.

One key checks I searched for is that the broker has to be registered in Nigeria. And it has to be regulated in some well known financial hub like US, UK, Cyprus, South Africa as this would safeguard Nigerian traders.

Why did I not say regulated in Nigeria? Because there is no forex broker who is regulated in Nigeria.

After checking the basics, then I start to look into the broker’s platform, their fees, ease & time take during funding & withdrawals, the customer support (does it have live chat, phone number & emails or not).

Based on everything I have test, for this review only I’ve then given each broker a rating out of 10.

Here’s a 10 points Checklist (originally it started with 7, and overtime I believe it will expand) that I’ve built overtime & you must review these points in every broker before signing up & depositing funds.

There are various regulations that are in place globally for foreign exchange & CFD brokers. These regulations ensure that traders do not lose money due to illicit activities such as fraud and manipulation by the broker. These regulations also safeguards the money that the traders deposit with the brokers, in case of any event by ensuring segregation of funds.

These regulatory authorities protect the Investor’s money & also provide oversight in case of any violation by the broker. The key objective of regulatory authorities is that the brokers provide transparent services and comply with the laws.

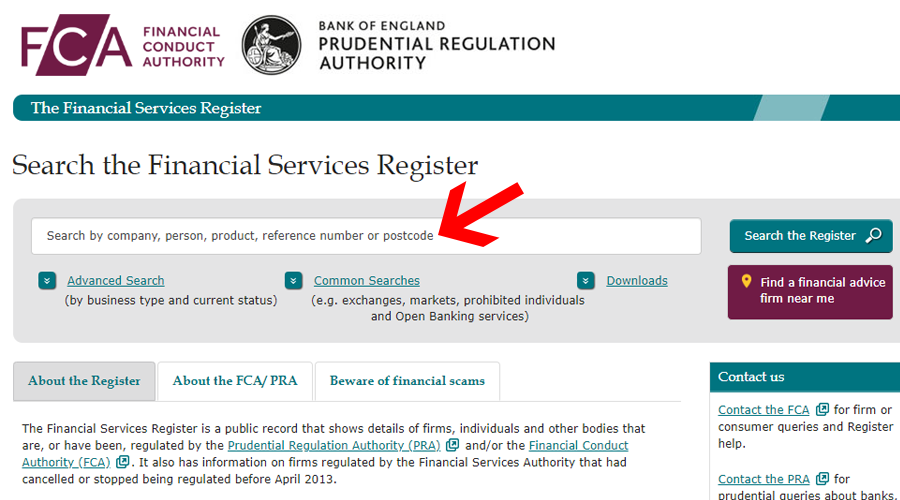

Thus, if you are looking for a Forex broker, you should check whether the broker is registered and licensed or not.

Further, you need to check the broker’s past track record in terms of being banned or fined. The best brokers are usually the ones who have a clean track record and offer transparent services to the investors.

Also, remember that not all regulations are the same. Many CFD brokers register their clients under offshore regulation like IFSC (Belize), FSA (Mauritius) etc. Avoid broker that is regulated only with Offshore regulations, and not with any Top-tier regulators. A good forex broker will be regulated with multiple Tier-1 regulations like FCA, ASIC, CySEC etc.

You can check the CFD broker’s regulatory information on their website. Generally, in most cases you will find the regulated brokers highlighting their regulation throughout their website (mainly the footer section of the website), and will also have a page for regulatory information.

To give you an example, FXTM is regulated by FCA, FSCA & CySEC, which makes it a safer choice for traders in Nigeria compared to brokers that are not licensed anywhere. Similarly, HF Markets (HotForex) is also well regulated as it is licensed by FCA, FSCA, CySEC & few other major regulators.

Both these brokers mention their regulatory license numbers on their website footer section. Here is an example from FXTM’s website which mentions their license numbers.

Also, ensure to check the broker’s license number on Financial regulator’s website (most have a public search page to find regulated/licensed brokers). Some brokers may claim to be licensed, but in reality might be using a fake license number.

It is really important to know the just because a broker is regulated with a Tier-1 regulatory body like FCA or ASIC that they will open your account under that regulation. What brokers generally do is register clients from Nigeria under some offshore jurisdiction like Seychelles or Mauritius.

The regulators in these offshore countries have very relaxed technical & regulatory requirements. For example, FCA mandates that regulated brokers must restrict leverage to 1:30 maximum on major currency pairs & they also have very strict reporting requirements. So, what these brokers will do is get a license with FCA to get credibility among traders, but won’t necessarily register traders under that jurisdiction.

But to be fair, these brokers are not required to register clients from Nigeria under FCA or ASIC, so they can choose to register the traders from this region under regulators that will not ask them too many questions. As soon as the regulation of one offshore regulator becomes strict, these brokers then simply move to a different offshore jurisdiction.

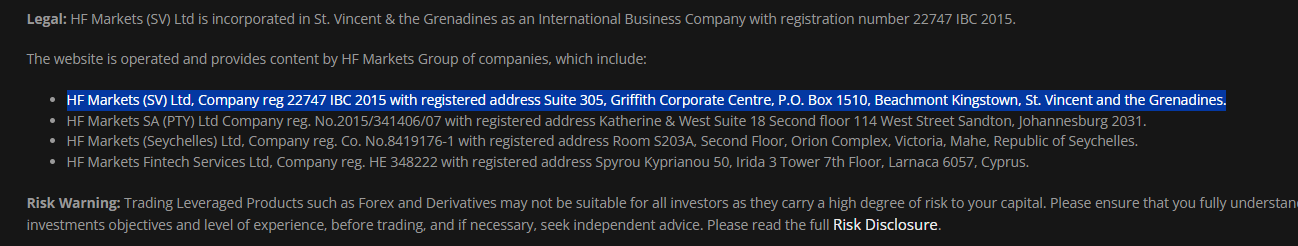

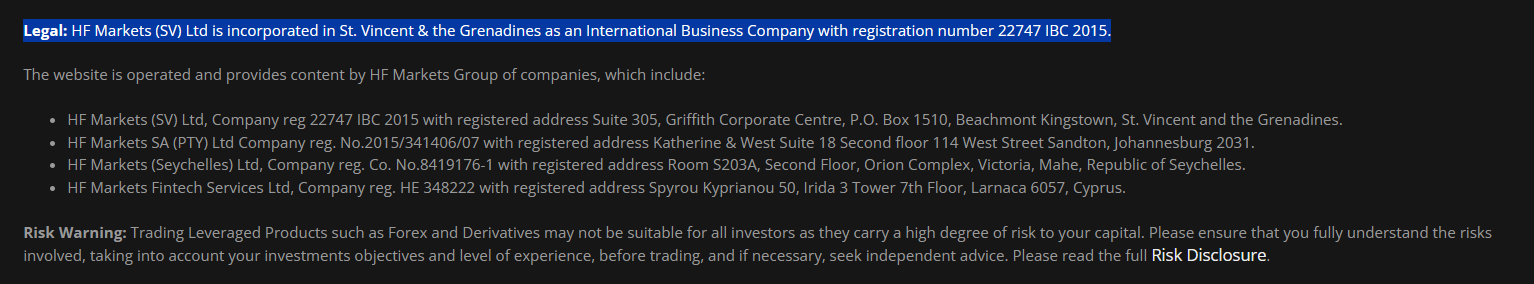

Take HFM for example, they are well regulated under some major regulations. See the screenshot below (it does not include their CMA & FCA license)

But traders from Nigeria are signed up under ‘HF Markets (SV) Ltd’, which is an entity based in St. Vincent and the Grenadines. Since there is no legal requirement or obligation to register Nigerian traders under some major regulations, so HFM (and all other brokers), simply opens your account under this offshore entity.

Another critical aspect to monitor is the reputation and reviews of the broker. There are numerous broker review websites (including us) available online that can provide you with editorial as well as user reviews regarding the brokers.

In addition to this, another way is to ask the existing traders about the brokers. They will be able to guide you on the brokers that you need to avoid & the ones that you can go for.

Did other traders experience any issues with the broker? How is the feedback of the users of the mobile app on Play Store? Is the broker active in responding to serious issues?

By comparing the reviews of brokers and analyzing their reputation, you will be able to make an informed decision on which broker you should choose.

If a broker a lot of negative reviews related to issues such as withdrawals, manipulation of price, spread widening etc. then it should be a red-flag that you should not ignore. Multiple users reporting the same issues is generally a sign that something may be wrong. But of course you should able to distinguish between general customer support issues from broker ‘red flags’.

Another aspect of the broker that you need to consider carefully is the trading platforms that a broker is offering. Usually, the best brokers in the business will give you multi-platform access i.e. the ability to execute trade orders from anywhere and from any device.

There are some brokers which only allow you to trade only through a web-based interface. It is always better to choose a broker which has a mobile app interface as well, so that you can even trade remotely & manage your orders from your phone. Most of the forex brokers offer their trading apps on iOS & Android.

All the brokers that I have included in my list will allow you to trade on the most popular forex trading platforms i.e. MT4 & MetaTrader 5. MetaTrader includes numerous tools & features like charting, technical analysis tools, news feed, Expert Advisors & multi device support.

Normally, the brokers will list all their available platforms on their website. And it matters to check it!

For example, many traders in Nigeria prefer MetaTrader 4 platform over others. But some of the brokers like Plus500 & eToro for instance do not offer MetaTrader, both these brokers they instead only have their own proprietary platforms for traders.

To check the platforms available, you should visit the website of the broker that you want to signup with. For example, Octa list their available trading platforms in the menu section of their website (see the below screenshot). They offer MT4 & MT5 platforms, and they mention it clearly.

Similar to the above example, you can check the available platforms at other brokers as well. Or you can talk to the broker’s support team to ask which platforms do they offer.

It is important to check if you preferred platform is available or not. Let’s take MetaTrader for example, in which some features that are available on MetaTrader, like multiple indicators, availability of EAs may not be available at the broker’s proprietary platform.

So, you should check out this information before signing up, whether the platform of your choice is available or not. But if you are comfortable using proprietary platforms by brokers too, then you should not be too concerned.

Another important aspect to consider is automated trading in the platform. There are some brokers that offer copy trading platforms on multiple devices, but it is important to understand the risks involved when you are trading the strategies of other traders.

Forex Broker’s fee is another crucial factor to be kept in mind. There are many CFD brokers that will charge a high amount of fees in form of hidden commissions on trades, swap fees, high fees on deposit/withdrawals etc.

It is really important that you carefully consider the various fees a broker might charge you before signing up.

Spread: You should only choose a broker that offers the lowest spread & funding fees. Spread is basically the difference between the bid price and the ask price of a currency. The lower the spread, the better it is for you since you will have to pay lesser to the broker on your trade.

You can check a forex broker’s spread for each currency pair on their website. Almost all CFD brokers list their ‘Available Instruments’ & the associated fees, spread for each instrument.

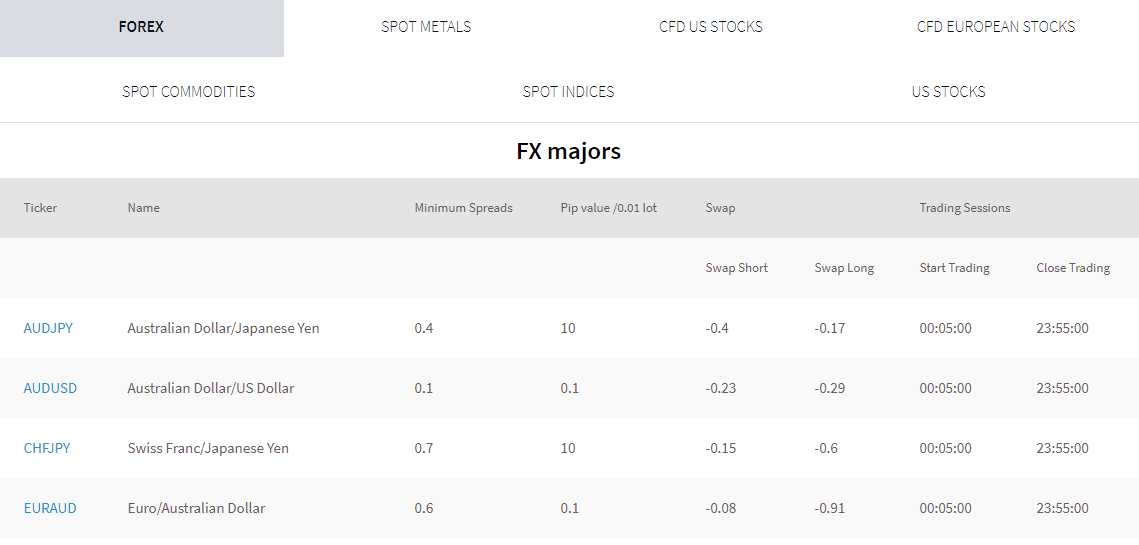

The above example highlights the EUR/USD spread at FXTM with each account type. You can browse their spread with each account type & then compare. Similarly you can check the spread for other instruments by checking contract specifications for every instrument on ForexTime.

For example, the typical spread for major like EUR/USD with FXTM’s Micro account is 1.9 pips. So, if you place an order for 1 Standard Standard lot, then the fees will be $19. But with their Advantage account, the typical spread is 0 pips + $4.88 commission per lot. The total fees for 1 Lot trade would be $4.88. So, it would make sense to open Advantage account for lower fees.

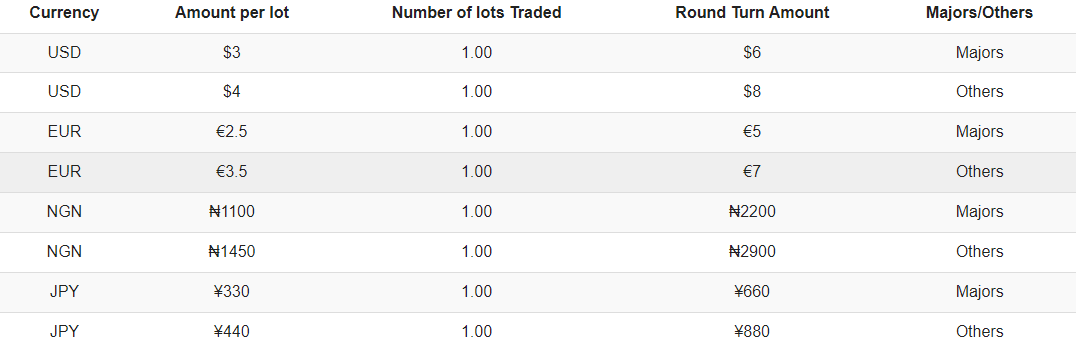

Commissions: Also check if there is any extra commission per lot with the account type. Some brokers like XM, Octa offer spread only trading accounts. While HFM, FXTM, IC Markets also have trading accounts with Raw spreads plus commission per lot.

The above screenshot from HFM’s website shows their commission per lot with their Zero Account. So, the total trading fees with this Trading Account is spread + commission. Both these depend on the instrument that you are trading.

For example, if you are trading 1 Standard Lot EURUSD at HFM, with Zero account their typical spread for this instrument is 0.1 pips & the commission for majors is $6 Roundturn. So, the total trading fees with this trade will be $7 ($1 spread + $6 commission) per Standard lot with this example (plus Swap for overnight leveraged positions).

Swap Fees: This is the fees charged by forex brokers for overnight trades. This fees depends on the broker, some brokers have very high Swap Rates, while some have lower.

For example, the Swap fees at XM broker for EUR/USD is -5.3 for Long & -0.9 for Short, as compared to -0.63 for Long & -0.08 for Short at FXTM, and -1.03 for Long & -0.64 for Short at Octa. The Swap fees at XM are very high as compared to other forex brokers.

You will find the reference to the Swap Fees under the specifications of instruments at forex brokers. For example, below is the screenshot from XM’s website which highlights their Swap Rates for all their Currency pairs.

The overall fees would be higher if any of the spreads, or commissions or overnight fees are higher.

Non-Trading Charges: Some forex brokers also charge traders in the form of extra charges like deposit/withdrawal fees, currency conversion fees, inactivity fees etc.

a. Some brokers charge you extra fees when you are depositing or withdrawing funds. This fees may not apply for all payment methods & can vary depending on your payment method. For example, some forex brokers charge even 2-3% for withdrawals to some wallets. This can eat up all your funds.

Check on the broker’s website, the exact fees they charge for your preferred payment method. For example. FXTM (screenshot below), does not charge any fees for funding & withdrawals via Local Bank transfer in Naira. But there are withdrawal charges when you withdraw via your VISA card.

b. You should also check what fees does the broker charge during currency conversion. To explain it simply, if your trading account is in USD base currency, and you deposit via bank account in Naira, then your funds would be converted to USD.

Depending on the exchange rate that your broker applies during funding & withdrawals, you can lose a lot of money. It is not uncommon for this fees to be higher that 10% for deposits & withdrawals combines.

One of the most important metric that I give importance to while comparing and recommending a broker is the standards of customer support.

You never know when you might need help while executing/closing any trade, or with withdrawals. A good broker will offer you excellent round the clock phone, email & live chat support during the week.

Make sure to check that the broker has customer support available via the following channels:

a. Live Chat which is available 24/5 at-least

b. Email Support

c. Local Phone Support in Nigeria

Also, the customer service provided by the broker should be efficient & helpful as well. You don’t want promises, you need actual problem solving & quick resolution of all queries. The Best brokers that I have recommended offer good multi language support via phone, live chat & emails.

To test the support of a Broker, you should ask questions with the broker’s live chat, email & phone support. Check how they respond to your questions, and were all your queries answered. If yes, then it is a positive sign that the broker’s support is okay.

Also, if the forex broker has a local office in Nigeria, then it is considered a positive thing. But this consideration should not override the first & most important consideration, which is the regulation of the forex broker.

It is good if the broker has a clear FAQ section & knowledgebase on their website for getting quick answers to simple queries without having to contact them.

As per my research, I have found that HF Markets has good live chat support & local phone number in Nigeria. While Exness has the lowest rating in terms of support, as their live chat team is very slow in responding to questions.

Normally, it is good if your broker is responsive via live chat. For email, the benchmark should be a response within few hours.

Most forex brokers now offer wide range of CFD trading instruments like US & EU stocks CFDs, metals, commodities, cryptos etc. other then range of major, minor & exotic currency pairs. This allows you to trade multiple asset classes & gives you chance to diversify your trading.

You should check carefully whether the instrument or currency pair that you want to trade is available at the broker or not. In most cases, the good forex brokers will list all the available instruments & it’s trading fees directly on their website. So you would be able to check it before making a decision about a broker.

As an example, this ‘Contract Specifications’ page on ForexTime’s website has a table of all the trading instruments which they offer. The table also shows their fees for each instrument, plus you have the option to check the each instrument individually & check fees with each account type.

If you are not able to find this information on the broker’s website then talk to their support & ask for this information.

Find out the exact fees for the instrument that you want to trade mostly & then compare it with the fees that other regulated forex brokers are offering.

Important note: You should look at the overall fees (spread, swap charges, deposit/withdrawal charges etc.), and not just the spreads. This will give you an idea of which broker is good for the instruments that you want to trade.

It is really important to look at the fees for your trading as it can add up over time & eat up all your profits. According to us, many traders who trade a lot (and in high volume), are at risk of very high charges. So, you must make sure that you either trade less, or if you have to trade more, then you should compare the fees you are paying for each asset class with the fees at other similar brokers.

You should check the range of currency pairs offered by the forex broker. This is an important criteria if you don’t trade only the major pairs.

As a general rule, if your forex broker offers more than 50 currency pairs, then it is good. Some forex brokers like Octa offer less than 30 currency pairs, while Exness offers more than 100 pairs.

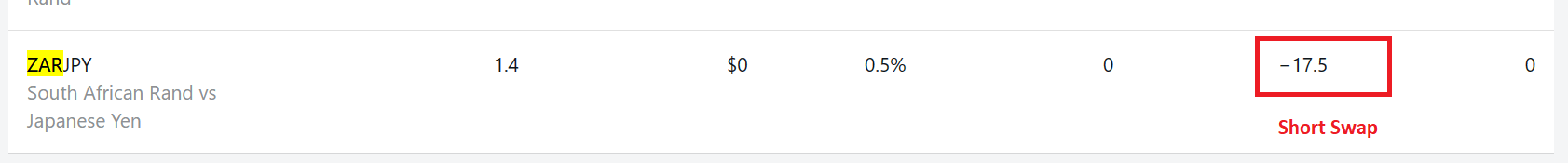

If you trade positive carry pairs like ZARJPY, then you need to check if your broker offers it or not. You must also check the Swap fees for trading that currency pair.

Below is the screenshot from Exness’s website. They charge a swap fees when you are longing JPY against ZAR, but they don’t pay any positive carry, when you are holding ZAR. This is a negative point against the broker.

So, you must weigh these factors, when checking the number of currency pairs. You must look for the exact pairs that you want to trade, and does the broker offer support for the reasons of your trade (example, positive carry).

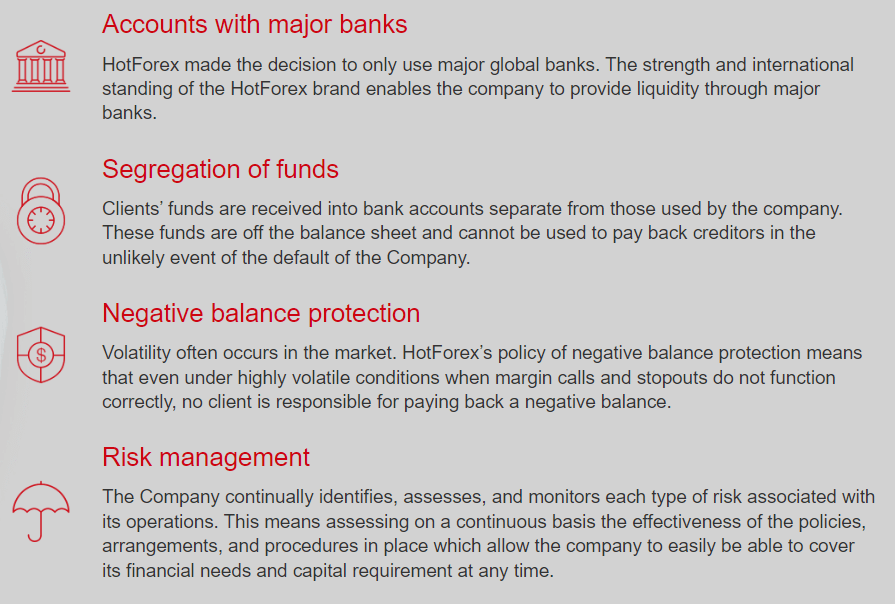

Also check if your broker has tools for risk management including: negative balance protection, guaranteed stop-loss feature, deal cancellation (some brokers may offer this for extra fees).

For example, one of the important features to check is if the forex broker has Negative Balance protection.

Let’s take an example of HFM. Look at the screenshot below.

They mention that they offer Negative Balance protection. So, during volatile market conditions, if the market goes against you too much, and your balance goes into negative, then HFM will change it to zero balance.

This is really important, because otherwise, your losses could exceed your account balance. Which means, you could lose more money than the balance in your trading account. So, you must check if your broker has this feature.

Also, some foreign forex brokers also offer ‘Guaranteed Stop-Loss’. Traders can get this feature for a fixed fees. This is another form of risk protection, which can be helpful during very high volatility environment.

Let’s see an example of this using some trade placed on EUR/USD nearing a news event like CPI data of the US. During such an event, the ticks can move fast in a direction, depending on the data.

For example, if you were long EUR/USD at 1.0550 before the news, with the current price at 1.0564 & your stop loss at breakeven. You are up by 14 pips. But the news event causes the price to go down 50 pips within seconds, you forex broker probably will cause slippage & not fill your stop at the price you had set.

But forex brokers that offer guaranteed stop loss protection have to guarantee that your stop loss is filled/hit at what you entered. These brokers generally charge a fees for managing this risk.

Also, you should ask does the broker’s app supports these features as well, and the popular indicators like MACD, RSI etc. or any other tool that you usually use in your trading. It is best to test this out on their platform with the broker’s demo account before depositing any real money.

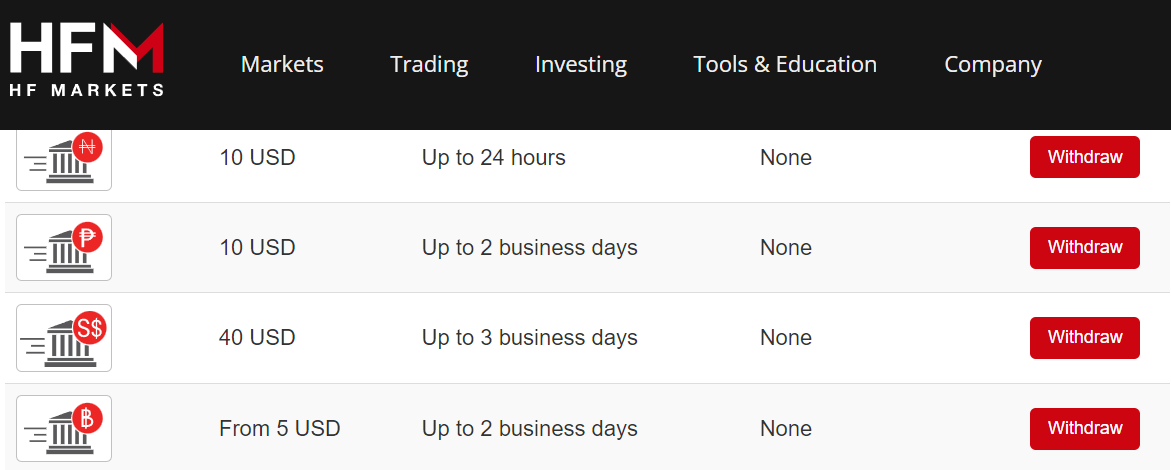

Nigerian traders should also check the withdrawal time & methods available. For example, your broker should offer withdrawal in Naira via bank accounts.

HFM broker accepts deposits & withdrawals in Naira via Bank accounts. The withdrawals can take 24 hours, and there is no extra fees with it.

Similarly, other brokers mention their payment methods & time to deposit/withdrawals on their website or dashboard. You should make sure that your broker offers local payment methods as there would be no extra conversion fees.

When you are using methods like card, or cryptos, there may be extra currency conversion, and transaction charges involved. Most brokers that accept NGN bank transfers don’t charge any extra fees for funding or withdrawals. These brokers include FxPro, HFM, Octa etc.

Therefore, you must check what payment options are available, what is the minimum that you can withdraw, is there any charge involved. Ask these questions from your broker if these are not clear.

Only a few forex brokers offer Naira as option for the trading account’s base currency. One of the advantages to having your trading account in Naira is that you will save on currency conversion charges.

Let’s understand this by using any example. If your new trading account is in USD let’s say, and you want to fund it. Since you are based in Nigeria, the likely option you will use is to use Bank transfer from your account (which is in NGN).

Since your trading account currency is USD, your forex broker will show you their exchange rates for funding your account. This exchange rate normally has a 2-5% mark-up, thereby, you are being charged extra.

But if your account is in Naira, then there is no conversion done during transfer of funds to your trading account. So, there are no extra charges by your forex broker.

Checking which account currencies does the broker offers is easy. The information is commonly linked to the ‘Trading Accounts’, so you will see which accounts can be opened in which currencies.

Like the following screenshot example from HFM’s website, which shows that they have NGN account currency available with their Pro Account. Forex Brokers Exness, FXTM also offer Naira account currency to traders who open their account from Nigeria.

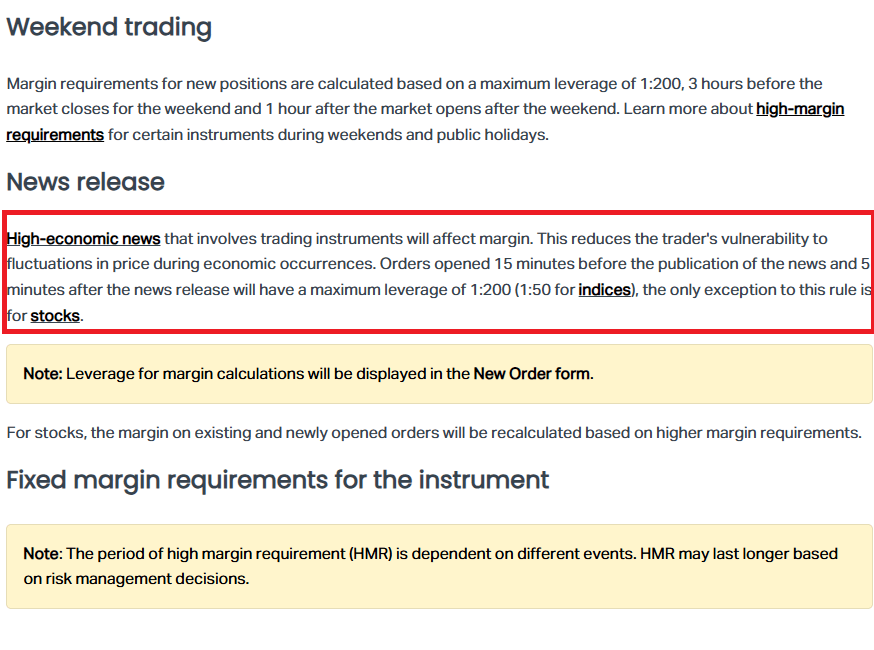

This is important to consider if you are using very high margin on your trades. Even if you are not, for specific instruments the margin requirements can be higher or change when there is a market event.

For example, if there is an upcoming BoJ meeting, where it is expected they could do some intervention, your broker could change the margin requirements for JPY pairs, which could affect your active positions & give you margin call even.

Generally, when there is any change in margin, your broker will inform you on your email. Therefore, you should regularly check emails from your broker as this could affect your trading positions.

For example, in the above screenshot from Exness’s FAQs, they mention how the margin can be affected for many reasons, including economic events. Check the exact margin required of your position, and watch out for any changes (including reasons for that change).

Forex brokers typically make their money from the trading volume of the traders. The CFD brokers charge you spreads (in pips) per trade or commissions per lot.

For example, a typical broker may have 1 pip spread on EUR/USD. This would make the spread as $10 for every 100,000 units traded or per standard lot.

Generally, in the forex market, a broker can have billions traded on their platform daily. For example, if 1 billion USD is being traded monthly, then at 1 pip spreads, the broker will make USD 100,000 in that month.

Other brokers who are market makers can even take opposite side of your trades & make money from your losses. Therefore, you should avoid trading via a market maker broker.

There is no forex broker that has a license to operate in Nigeria. All the forex brokers who are accepting & signing up Nigerian traders are offshore or foreign licensed.

For example, the major broker like Exness opens the accounts of Nigerian traders under “Exness (SC) Ltd”, which is licensed in Seychelles. And they are a market maker broker.

Therefore, it is important to know that you are at risk if your broker is not genuine. This is the risk except from the actual market risk, that your broker could very well be a scam broker.

The only way to somewhat protect against scam brokers is to only deal with reputed brokers who have registered themselves with more than one Tier-1 regulations, because no forex broker is regulated in Nigeria.

The Professional trading accounts at forex brokers have the lowest fees in general. But these can hide the actual fees when trading. Look at the cost on the time you mostly trade.

For example, Exness, which on paper has lowest typical spreads, has EURUSD spread of 0.6 pips (Pro Accounts). But that is not always the case. In Asian session, the spreads are around 2+ pips on average. Even during news events, it is common to spike to 5+ pips.

This can affect your trading overall, depending on when you place your orders. Even 1 pip difference can increase your brokerage expense. For example, if you trade 2 Standard lots on EUR/USD in a day (500 in a year), and broker charges you 1 pip extra, that is around $5000 annually.

This expense is actually being subtracted from the P&L. Therefore, check if your broker has a policy of not increasing spreads unnaturally. Some brokers might make a claim that it is normal for spreads to increase under variable spreads account, but if there are other regulated brokers not doing so, then you can spot that this is a bad practice on part of the broker.

For Micro & Standard Accounts, the lowest minimum deposit for account opening is $1 at Exness. At most Nigerian forex brokers, you can fund your account in Naira (also withdraw in your bank account).

Different brokers have different deposit requirements, like 25 USD to Octa. If you are opening a Naira account (where your trading will be in NGN), the minimum is ₦50,000 at HFM for their Pro Account.

Note that the minimum account requirements are not the same as minimum deposit/withdrawal amount at payment methods. For example, a forex broker can have 0 USD minimum deposit, but at the same time require you to deposit 5 USD minimum when using your preferred payment method.

Deposit requirements should be one consideration in your forex broker, but the most important to check under this is whether the broker charges you any extra fees for using your preferred method, which is a red flag.

Your funds are not 100% safe with any broker, and the risk is much higher with some brokers. There have been events in the past where the brokers have gone bankrupt, and clients who had funds in their trading accounts were lost.

Forex brokers are exposed to market risk, and in case they don’t have proper risk management, they could fall into a situation where they don’t have adequate capital to cover the client deposits. This can happen in a situation where the broker has not properly hedged it’s client exposure.

On paper, clients who open account with brokers who have a license under the FCA are protected up to a certain deposit size. But the problem is that this is not insured for any clients outside the UK, therefore Nigerian traders will not get this investor protection from FCA licensed brokers.

Moreover, by default, when you open account with any broker from Nigeria, take HFM or Octa for example, both of them will open your account under an offshore entity, that does not have the same investor protection.

Below is an example of HFM’s entity under which Nigerian trading accounts will be held. This company is not based in Nigeria.

Since, none of the forex brokers in Nigeria offer investor protection offered by the regulator, you always have the counter party risk of your broker, who can have improper risk management practices.

There is no way to eliminate this risk. The only option you have is to accept that the broker can go bankrupt, so you should never have all your deposits with any single broker. But if a broker has good industry reputation, as well as license under FCA, ASIC & other regulators, the risk is lower, although it is not entirely eliminated.

| Forex Broker | Regulation | Spread (EUR/USD) | Leverage | Account minimum | Forex Trading Platform(s) | Start Trading |

|---|---|---|---|---|---|---|

| HF Markets | FCA (UK), FSCA (South Arica) | 0.1 pips with Zero, 1.3 pips with Micro | 1:1000 | $5 | MetaTrader 4, MetaTrader 5 for web & mobile | get started |

| FxPro | FCA, CySEC, FSCA | 0.46 for EUR/USD with cTrader account + $0.35 commission per mini lot per side. | 1:500 | N5000 | MT4, MT5 & cTrader. | get started |

| Octa | MISA, FSCA, CySEC | 0.6 pips for EUR/USD with MT4 & MT5 accounts. | 1:500 (Variable depending on account type & asset) | $20 (₦36,000) | OctaTrader, MT4 & MT5 for mobile, web and desktop. | get started |

| XM Forex | FCA(UK), CySEC, ASIC (Australia), IFSC(Belize) | 0.8 pips with XM Ultra Low | 1:888 | ₦1800 | MetaTrader 4, MetaTrader 5 for web & mobile | get started |

| Exness | FCA, CySEC | As low as 0.3 pips with Pro Account | up to 1:2000 | USD 10 | MT4 & MT5 for web, mobile devices, | get started |

| Avatrade | Avatrade | 1.3 pips fixed spread | 1:1000 | $100 | Metatrader 4 for desktop & mobile | get started |

| IC Markets | ASIC, CySEC | 0.62 for EUR/USD with Standard account. 0 pips + $7 with Raw account. | 1:500 | $200 | MT4, MT5 & cTrader. | get started |

| FXTM | FCA, Cysec | 0 pips with Advantage, 1.9 pips with Standard | 1:1000 | ₦10,000 | MetaTrader 4, MetaTrader 5, Webtrader, iOS, Android apps | get started |

| Alpari | CySEC | 1.1 pips for EUR/USD with Nano, Standard accounts. 0.7 pips with ECN accounts. | 1:1000 | ₦0 | MetaTrader 4, Metatrader 5, Alpari Mobile App, Alpari Invest App. | NA |

If you are a beginner trader then you must look for a broker that offers – a demo account, has low spread commission-free live trading accounts, must be regulated, and offer educational resources. Based on our research of 20+ forex brokers operating in Nigeria, here are our top picks:

Only HFM offers trading accounts with NGN as your base currency.

Octa, FxPro Exness & a few other brokers accept local payments & give withdrawals in Naira via bank transfer, but these brokers don’t have NGN base currency accounts. You can only select USD, EUR or GBP as your account currency with most of these brokers, if you opening your account from Nigeria.

Based on our comparison, HFM, Exness, Octa, FXTM & FxPro have local payment options in Nigeria.

These brokers have bank payment option, so you can withdraw your account funds in Naira directly to your bank account. But you must note that your broker will likely charge you currency conversion fees (higher exchange rates), for conversion of your USD account balance into Naira withdrawals. The same fees also applies during funding, if your deposit is in Naira, but account currency is something other, like USD or EUR.

To open your trading account you need to follow these 3 steps.

First you need to choose a good broker. You should look for a broker that is regulated with at-least 1 top tier regulator, has low minimum deposit, and offers good trading conditions like low spread, fast order execution & good support. For this you can check our list of best forex brokers for trading in Nigeria.

Second, once you have decided on the broker that you want to choose, you should go ahead & start with a demo account with that broker. HFM, FXTM & XM offer free demo accounts for beginners, so you can look into their demo accounts.

After you have practiced on the demo account & are comfortable with trading, then you can go ahead & open live account with the broker that you have finally decided on.

There are few things that you must consider. The most important is the regulation of the broker, make sure that the broker that you are about to choose is regulated with minimum 1 Top Tier regulator like FCA, ASIC, CySEC or FSCA.

Other important thing is to check the reviews of a broker, as this will give you idea about the broker’s history of dealing with their clients, their fees, support, platforms, execution. A good broker will generally have more positive reviews by genuine clients, and also see how the broker responds to negative reviews as this is a good indication of their support.

If you are a professional trader then you should consider an ECN broker or STP broker that offers Raw spread & the lowest commissions per lot for the instruments that you mostly trade.

Akin Benjamin

The author of this resource Akin is a head of content (African brokers) at the company. He has a background in finance with 7 years of experience as a forex trader. He has tested 12 brokers, and has also reviewed all the resources published on here to ensure that these are actual facts tested first hand & based on experience.

HFM is the #1 FX Broker

Visit