eToro is a popular crypto & copy trading platform but they don't accept traders from Nigeria as per the recent update of this review in January 2023. Read our full eToro review to find the alternatives.

Important Note: eToro does not accept clients from Nigeria any longer during the time of this review update in January, 2021. If this changes in future then we will update you accordingly.

Check out these alternative CFD & Forex brokers in Nigeria for trading Forex & Crypto CFDs.

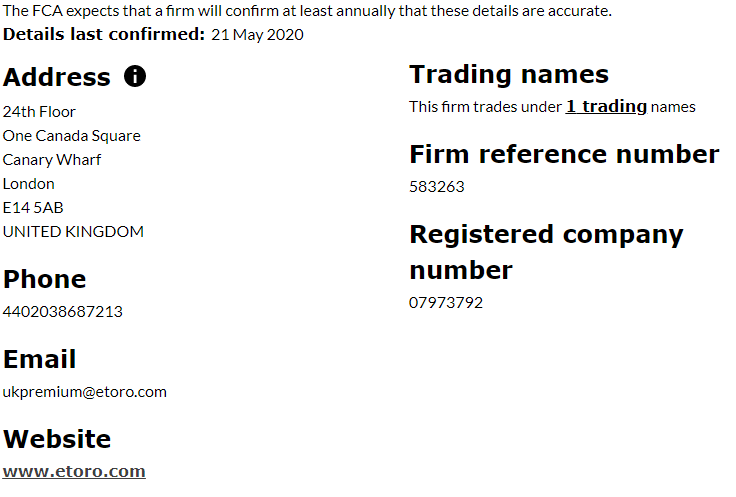

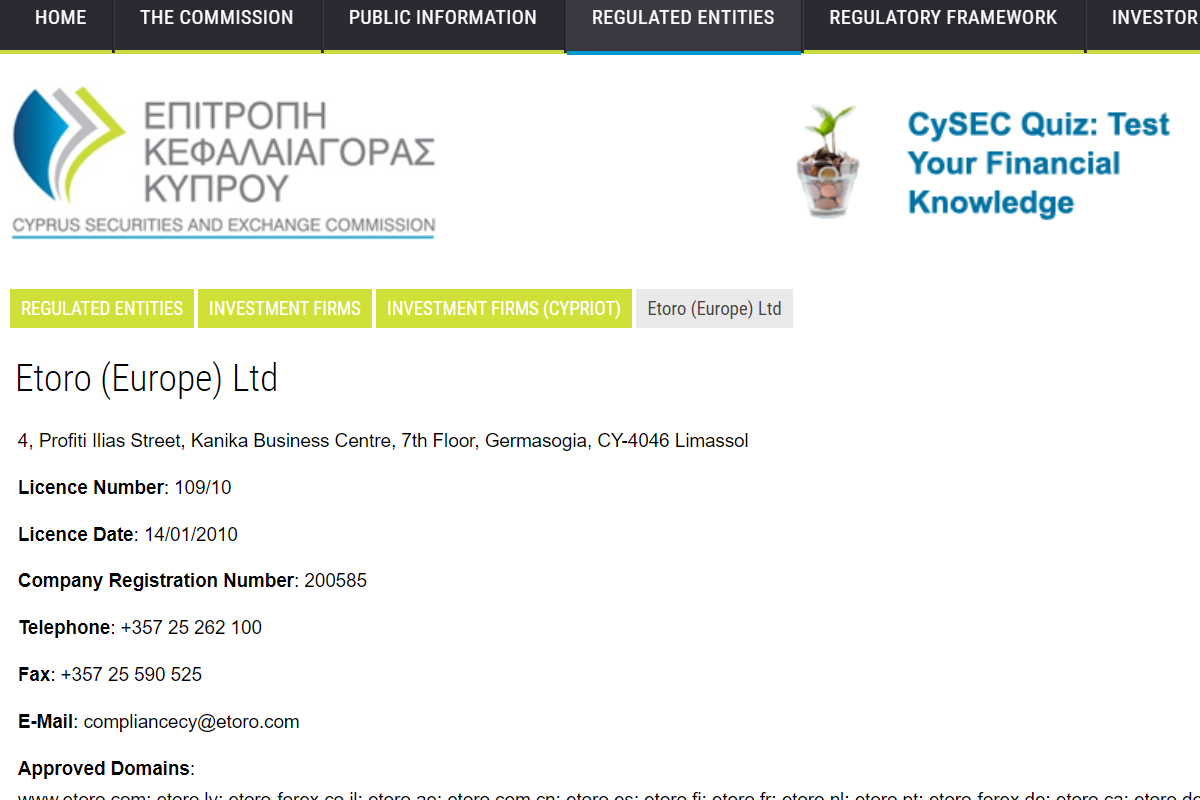

eToro is a social & copy-trading platform that was founded in 2007. They are regulated and authorized globally multiple by Top-tier 1 and 2 regulatory bodies. These include the FCS in the UK (Financial Conduct Authority), ASIC in Australia (Australian Securities and Investments Commission), and CySEC (Cyprus Securities and Exchange Commission).

eToro does not accepts traders from Nigeria for now. The minimum deposit required to open a Live Account is $200 for traders from accepted countries. You can deposit funds without any commission, through multiple methods. However, only USD Accounts are offered by eToro & withdrawal fees are applicable.

eToro offers wide range of CFD trading instruments including CFDs on Stocks, Commodities, Forex, ETFs, Cryptos, Indices.

Traders are offered Web & Mobile trading platforms by the broker, but desktop application is not available. Their support is okay.

We looked into all their features including fees, account types, regulations, available trading markets & more for this review.

eToro Pros

eToro Cons

Table of Contents

| Broker Name | eToro Nigeria |

| Year Founded | 2007 |

| Website | www.etoro.com |

| eToro Minimum Deposit | $200 |

| Maximum Leverage | 1:30 (for majors), 1:20 (for minors), 1:2 (for cryptos) |

| Regulation | FCA, CySEC, ASIC |

| Trading Instruments | CFDs on 49 Currency Pairs, 94 Cryptos, 31 Commodities, 10 Indices & 1000+ Stocks |

| Trading Platforms | Mobile App, Webtrader |

eToro is regulated by 3 well-known financial regulators. These include:

eToro is considered safe for online trading as their are regulated with multiple regulators. The broker is also a member of the UK’s Financial Services Compensation Scheme and Cyprus Investor Compensation Fund.

Moreover, you are offered several risk management features for ensuring the safety of your funds. The funds of all the clients are held in segregated bank accounts by eToro.

eToro also ensures the security of all the data of the clients as far as privacy and security are concerned. They make use of SSL for authenticating data transfers.

The fees with eToro are variable based on the instrument being traded. However, they offer commission-free trading and only spread, and swap fees are charged.

But, a withdrawal fee of $5 is applicable. Moreover, non-USD deposits will also incur conversion fees, since eToro only offers USD accounts.

Overall the trading fees (spread + commission) at eToro are not that high. But, the inactivity fees & charges on withdrawals are there.

eToro offers 2 very simple account types – Demo Account and a Live Account. The account opening process is quick & simple.

eToro offers free demo account. Demo Account is suitable for beginner traders, so you can get used to their platform. You are offered a comprehensive demo Account with virtual money, where you can test your strategy.

You can access demo account at eToro immediately after registration – even before the submission of your KYC documents. Demo account is perfect for trader looking to check eToro’s trading platform & those who are new to trading.

Opening a Live account with eToro requires a few extra steps than for the opening of your Demo Account.

You must first complete your account verification by submitting your KYC documents (ID proof & Address proof), before you can start trading live at eToro.

2 types of Live Accounts are offered b eToro:

a) EToro Retail Account

You can open the Retail Account at eToro with a minimum deposit of $200. The max. leverage offered is up to 1:30. All the financial instruments available for trading at eToro can be accessed under this account.

You can opt to trade with your own strategy or use the eToro’s CopyTrader feature. The latter permits/allows you to follow the trades of other eToro traders and copy them.

The leverage is restricted with this account. Negative balance protection is available for Retail traders.

b) eToro Professional Account

This account is for Professional traders, and you get higher leverage with this account.

But you will be required to fulfill certain criteria for demonstrating your past trading experience to qualify for the Professional Account. It is because of the higher level of risk that is associated with using higher leverage when trading CFDs.

Once you successfully establish your qualifications & background as a professional trader with experience, you can then open the Professional Account. The minimum deposit is the same as eToro’s Retail account i.e. $200.

You will be offered maximum leverage of upto 1:400 – depending on the trading instruments. You are also offered negative balance protection with this account by eToro.

If you are unsure, you should chat with eToro’s support before opening a Live account.

Wide range of instruments are available for trading at eToro. These include Cryptocurrencies, Forex Currency pairs, Stocks, Indices, ETFs, and Commodities.

You can trade over 2000+ CFD trading instuments with EToro.

1) eToro Bitcoin & Crypto trading

eToro offers CFD trading on wide range of cryptos including the majors i.e. Bitcoin Trading & Ethereum. 94 Crypto trading instruments are available at eToro.

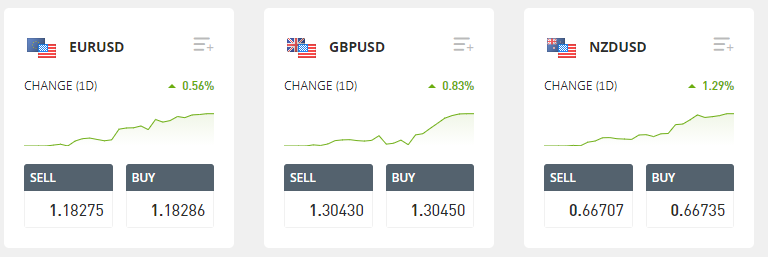

2) Currencies

49 currency pairs are available for trading. These include majors like EUR/USD, USD/JPY, AUD/USD, and GBP/USD. eToro’s currency trading spread is not that high.

3) Stock CFDs

1000+ stocks are available on eToro’s platform, which include some of the major global stocks. Some of the major stocks offered by the platform include Amazon, Facebook, Google, Tesla, and Apple.

You can trade these stocks as CFDs or actually own them.

4) CFDs on Indices

Indices Trading is offered by EToro. There are 13 indices available on their platform which include FRA40, SPX500, DJ30, NSDQ100, and GER30.

5) CFDs on ETFs

EToro offers you to trade CFDs on 151 ETFs.

6) Commodities

eToro offers 31 Commodity CFDs which include the major ones like Oil, Gold etc. Some of the most traded commodities offered by eToro include Gold, Silver, Natural Gas & Oil.

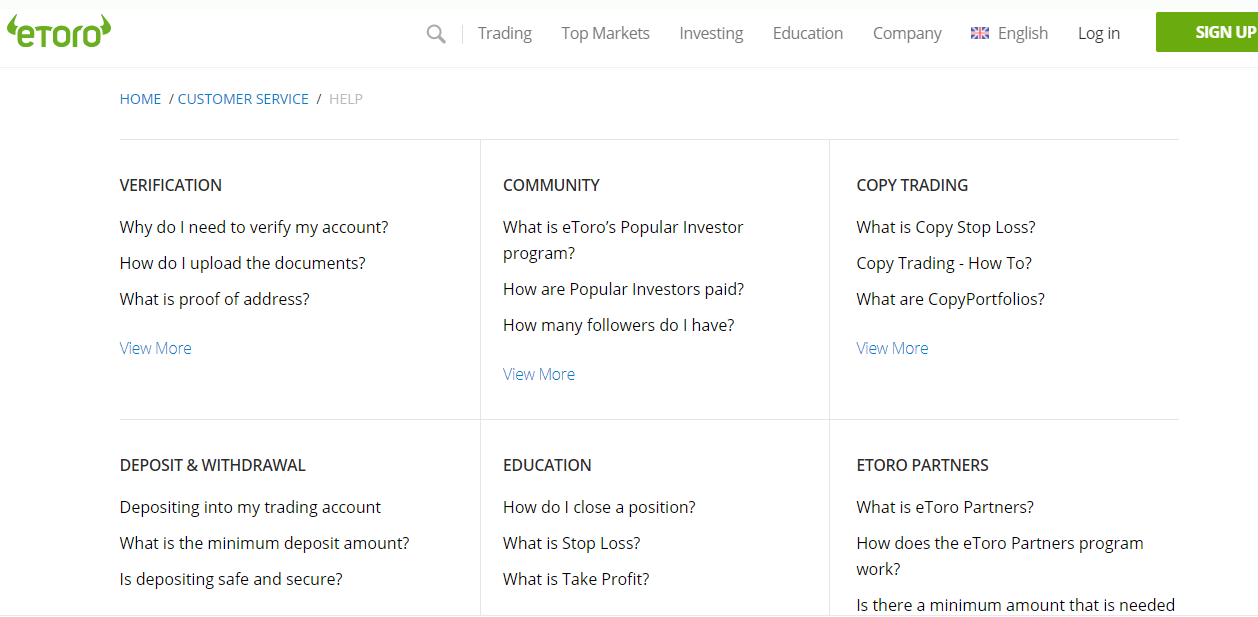

Traders in Nigeria can access the eToro’s Customer Support 24×5 i.e. from Monday to Friday. You can access the support through multiple channels.

You can fill the support ticket form on their website, and you will get a response on your email too. We received their response the next day, although it was slow but was helpful.

You can track your open/closed tickets and interact with the Support team through eToro’s Help Centre. It is very simple to use.

The topics covered include Verification, Copy trading, Deposits & Withdrawals & more.

Meanwhile, traders in Nigeria are not offered customer support through Phone.

Overall, the Customer Service at EToro is fair. However, their support is not accessible 24×7 and Live Chat is restricted only to logged in users, so if you are a visitor looking to get answers to your questions then you would need to open a support ticket in that case.

Since eToro does not accept traders from Nigeria, you can look at the list of best forex brokers & if you are looking to trade crypto CFDs, then refer to this list of Bitcoin Trading Platforms accepting traders in Nigeria.

On the plus side, eToro is regulated with 3 reputed Financial regulators FCA, CySEC & ASIC. So, in terms of safety of your funds, trading on their platform is considered safe.

Moreover, you can trade a wide range of markets through the eToro’s Trading Platform and Mobile App. Especially, their crypto trading instruments are quite large compared to other brokers. Plus, you can access their copy & social trading feature without any extra fees.

Their trading fees i.e. their spread is not that high, when we compare it to other brokers like Hotforex, FXTM etc. Their FAQs section is also easy to understand.

However, there exist some drawbacks as well. eToro non-trading fees are somewhat high and you can only open USD base currency accounts. This means you could lose on conversion during withdrawals & deposits/

Also, eToro’s Live Chat is only accessible for logged in users.

Overall, you can try eToro for its low spread & zero-commission CFD trading and their Social Trading features.

"Do you have experience with eToro Nigeria? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow Nigerian Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.