We've listed the 7 best True ECN & STP brokers in Nigeria that are regulated with multiple Top-Tier Regulators. See our comparison of fees, commissions & more factors!

Forex trading has exponentially grown in popularity in Nigeria over the last decade. Retail forex traders in Nigeria can now participate in the forex market through international brokers that are regulated by Top Tier forex regulators such as the FCA, CySEC, or the ASIC.

Trading through a well regulated broker is essential to avoid fraud or financial scams that are prevalent in the forex market.

Forex traders have the option of trading through an ECN/STP broker or through a market making broker. ECN/STP brokers are different because they follow the No Dealing Desk (NDD) model whereas market maker brokers follow the dealing desk (DD) model.

List of 7 Best ECN brokers in Nigeria for 2020

There are pros and cons attached to both types of brokers. Trading through an ECN/STP broker may advantageous since there is no conflict of interest between the trader and the broker. Further, an ECN broker may also charge lower spreads which could help you trade at a lower cost.

While looking for an ECN/STP broker to trade through, beware of fake ECN/STP brokers. You should only trade through a true ECN broker that follows the NDD model.

To help you find trustworthy ECN brokers, we have only included ECN or STP brokers that have an NDD model and are regulated by Tier 1 forex regulators in this list.

Ranks #1 ECN Broker in Nigeria

Hotforex is an international forex broker that is regulated by three different Top-Tier Regulators. These regulators are the Financial Conduct Authority (FCA) of the UK, the Financial Sector Conduct Authority (FSCA) of South Africa, and the Cyprus Securities and Exchange Commission (CySEC) of Cyprus.

Hotforex is considered to be a safe broker to trade through as they are well regulated globally. Forex traders who are based in Nigeria will be registered under the Financial Services Authority (FSA) of St. Vincent & the Grenadine when trading through Hotforex.

Traders have the option of choosing between four different types of accounts when registered to trade through the FSA. The account types are Premium, Zero, Micro, and Auto. The fees that you will be charged by Hotforex will depend on the type of account that you hold. Each account has its own pros and cons.

Fees – Their Zero account is best suitable for high volume traders. The Zero account is an ECN account type. As an indicator of how much you will be charged when trading through a Zero account, we may consider the benchmark EUR/USD currency pair. A trader will be charged a typical spread of 0.3 pips for the EUR/USD currency pair. You will also be charged a commission of $6 per 100,000 units when you trade through a Zero account.

Overall, the charges and fees that you may incur while trading through a Zero account is not the lowest, but still quite competitive when compared to other ECN forex brokers.

Trading Conditions – When using Hotforex, you have the option of trading 50 currency pairs which includes both major and minor currencies. In addition to forex, you can trade 56 CFDs on different shares, 7 cryptocurrencies, and other instruments.

Both MT4 or MT5 trading platforms can be used to trade through Hotforex. You need to hold a minimum account balance of $200 for Zero Account. The base currency can USD or EUR or NGN. There are no fees for deposits or withdrawals.

Support is good – Hotforex has a local Nigerian phone number that you can call for customer support help and queries. The chat option that is available is also quick and helpful.

You can also get in touch with them through email and their response time is quite good. Overall, we consider Hotforex to be good with customer support.

Hotforex STP Pros

Hotforex STP Cons

Also read our detailed Hotforex review

Ranks #2 ECN Broker in Nigeria

FXTM is an International forex & CFD broker that is regulated by the FCA, the CySEC, and FSCA. Being licensed by these multiple Top Tier regulators indicates that FXTM is a relatively safe broker to trade through.

In addition to tier-1 regulators, FXTM is also regulated by the International Financial Services Commission (IFSC). Traders from Nigeria are registered under this regulation.

Fees – The fees that FXTM charges depends on the type of account that you are holding. Even though the fees from their standard accounts may be considered high, the fees that charge for ECN account holders is quite low.

If you sign up with their ECN account, then you may expect to be charged a typical spread of 0.1 pips for trading the benchmark currency pair of USD/EUR.

They do not charge any deposit fees. However, they do charge a withdrawal fee of 1.5% in case you are choosing to withdraw your funds through a local bank account transfer. Rather than a bank withdrawal, you may withdraw your funds to a wallet in order to avoid this fee.

FXTM also charges a commission on every trade with their low spread ECN Account. Overall, their commission & fees for ECN accounts is lower than most other brokers.

Trading Conditions – FXTM ECN accounts allow you to use Naira as a base currency, other than USD & EUR. You can also make deposits and withdrawals in Naira, which is convenient for Nigerian traders.

FXTM offers three different ECN accounts which are the ECN Account, FXTM Pro Account, and ECN Zero Account. Even though most characteristics are the same for each account type, the spread & commission that you are charged may differ. The FXTM Pro Account may be the most cost-effective account to trade through, if you are a high volume trader.

You can trade through FXTM by using either a MetaTrader 4 or a MetaTrader 5 trading platform. The speed of order execution is quick.

Through FXTM, you have the option of trading all major currency pairs along with several minor currency pairs. You can also trade CFDs on spot metals, share CFDs, commodity CFDs, and cryptocurrency CFDs.

Customer Support – To contact customer support, you can get in touch with them through a local phone number. This phone number is available at all times on weekdays.

You can also contact them through email or Live Chat. Additionally, they have offices in Lagos and Abuja, so you can visit their offices if required.

Overall, they offer quick and helpful customer support.

FXTM ECN Pros

FXTM ECN Cons

Also read our detailed FXTM review

Ranks #3 ECN Broker in Nigeria

IC Markets is an Australian CFD broker that offers Raw Spread trading account, with as low as 0 pips spread + low commission per lot.

IC Markets is licensed with Tier-1 regulator ASIC, as well as with other major regulators. So, they are considered a low risk CFD broker, even though the Nigerian clients are registered under Offshore regulation.

Fees – The typical spread with their Raw Account for major like EUR/USD is 0.02 pips. But there is a commission of $3.5 (per Standard Lot), per side. So, the total commission for opening & closing the trade would be $7.

If you are trading Mini Lot, then this would calculated to be $0.7 commission on a trade. If the spread is 0 pips for any major, then the commission would be the only trading fees. This makes their fees very competitive.

Trading Conditions – You can trade most of the major asset classes on their platform. For example, you can trade CFDs on commodities, major & minor cryptos, global indices like NASDAQ, and also on metals.

Customer Support – The support at IC Markets is fair. We were connected to their live chat within few minutes, which is quick in comparison to other brokers, and we did not experience slow responses to our queries.

There are a few factors that you must consider while selecting an ECN forex & CFD broker.

1) Spread & Commission: Check the overall spread + commission that the broker is charging with their ECN account. If the spread is low but the commission per lot is high, then also the overall fees becomes higher.

You must also consider the fact that brokers will show you commission on their website for single side. The overall commission is calculated for both sides i.e. for opening a position & then closing it.

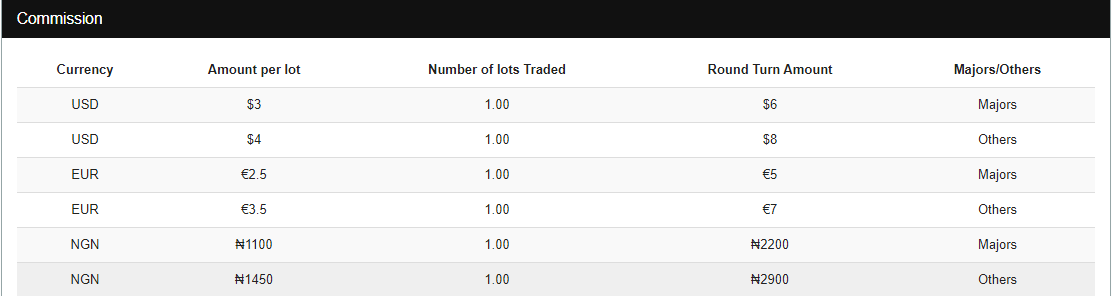

The below example table from HotForex’s website shows their Round Turn commission with their Zero Spread account.

The fees also varies for different instruments. So, always compare the total commission + spread with the ECN Account.

Another important fees to consider for traders that keep their positions open overnight is the Swap fees. This fees can add up to a lot. Some brokers have higher Swap fees than other brokers, so make sure to compare the Swap fees exactly for the instruments that you trade.

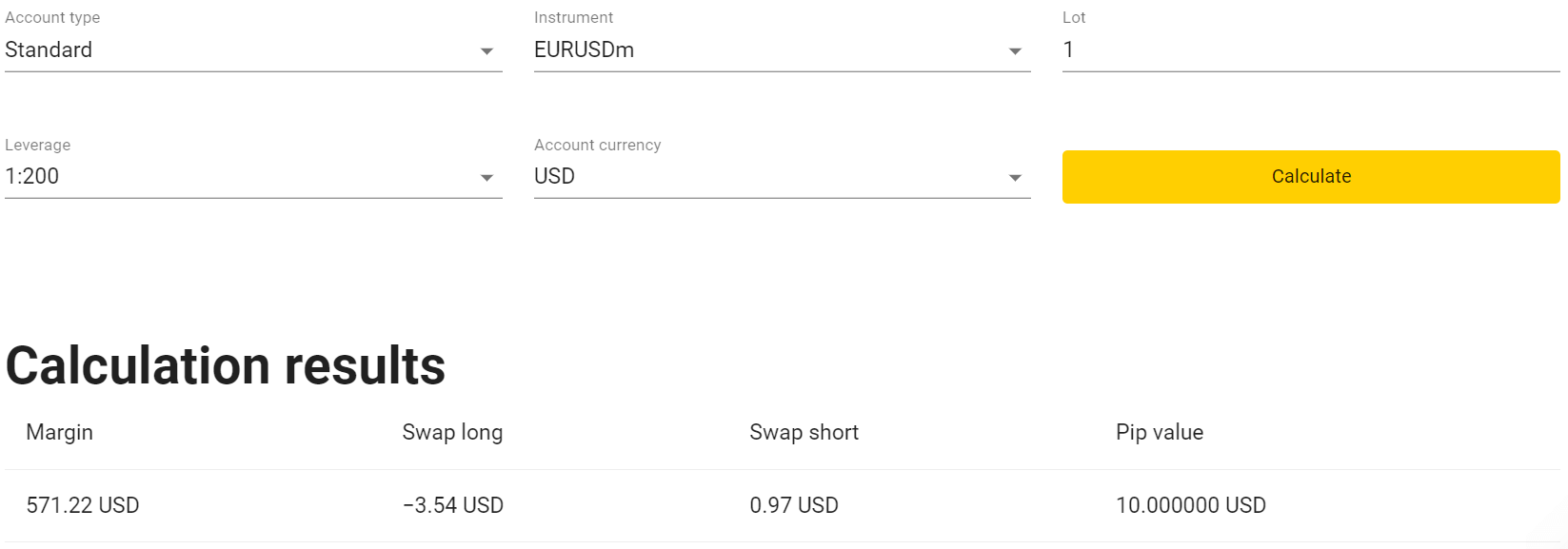

If the broker has a calculator on their website for calculating Swap, then use that calculator. As an example, Exness have a trading calculator on their website to calculate the margin requirements & Swap for each instrument.

Similarly, HotForex also has similar calculator on their website. Get an idea of the exact overall trading fees that you will have to pay when you are trading an instrument of your choice. If it is EUR/USD, then compare the total fees that you will have to pay at each of the regulated forex broker.

2) ECN Broker’s Regulation: Checking whether the ECN broker is regulated or not is probably the most important factor that you should consider.

Just because a broker has low fees & seemingly good condition does not mean that you can choose it without any other considerations. The broker probably could have other incentive for offering such a fees.

Always check if the CFD broker is regulated by Top-tier financial regulators or not. A good ECN broker would be regulated by 2 or more Tier-1 & Tier-2 regulations like FCA, ASIC, CySEC & FSCA etc.

If a brokers is regulated by most of these regulators then it is a good sign that they can be trusted.

Also, make sure to verify the broker’s regulatory license from the Regulator’s website. Some brokers that are unregulated & are likely to be a scam may pretend to be licensed.

It is important to understand that all the Tier-1 regulated forex brokers that accept traders based in Nigeria register their clients under Offshore regulations to offer high leverage, and bonuses. But if the broker is regulated with multiple major regulators, it is a sign that you can trust that broker, and your funds will be safe, with very low risk that the broker is a scam.

So, carefully verify the broker & watch out for unlicensed ECN brokers.

3) Account Features: Check the features that are offered with the Broker’s ECN Type account. Does it have support for Negative balance protection, is Naira based account available (if that is your preference), how is the trading execution speed, what platforms are supported etc.

Ask the broker questions regarding all the features that you need. Also, it is important to understand that a True ECN broker would offer market execution with No Dealing Desk. If a broker claims to be an ECN broker but offers Instant execution, then it means that something is off.

Do a thorough check. In general, if the broker is well-regulated, then you can consider it to be low risk. And if such a broker offers ECN Type account, then your risk becomes lower as opposed to a broker that is unregulated.

There are few brokers that follow STP model & offer ECN type accounts. Here are the best ones:

ECN stands for Electronic Communication Network whereas STP stands for Straight-Through-Processing. ECN and STP are two different methods by which no dealing desk (NDD) brokers operate, however, for a forex trader they will in most case effectively the same, if you are trading with a reputed & well regulated STP broker.

Essentially, ECN brokers connect you with other traders in the forex market so that you can affect your traders. This means that instead of trading with the broker themselves, you are trading with other traders on the market.

This helps you to avoid any conflict of interest with the forex broker. Also, the ECN method of brokering is cheaper and you will be charged a lower spread for the services of the broker.

Market makers are also known as dealing desk brokers and they are fundamentally different from no-dealing desk or NDD brokers.

A dealing desk broker acts as a counterparty to your trades. Essentially, they are making a market for you to trade in. They make their money by charging you a spread. The spread of a market maker broker is usually higher than that of a NDD broker.

There are advantages and disadvantages to trading with each type of broker. The main difference is that you will have to pay a lower spread when trading through a NDD broker but you may also be charged a commission. Hence, you need to decide on what works out cheaper for you as a trader. Whether you are more comfortable paying a higher spread or paying a commission?

Also, with the market maker there may be conflict of interest, since the broker in such a case would likely make money when you lose. So you should prefer ECN brokers if you are a trader that trades very high volume. But if you are a beginner, then it is best to choose a reputed forex broker that offers commission free spread only trading accounts.

ForexTime is the #1 STP/ECN Broker

Visit