XM is our 4th ranked Forex Broker for Nigerian traders. We like XM for its fast order execution, competitive spread, quick & zero fees withdrawals and wide trading instruments. Read our full XM Forex review to find out whether they are a good choice for you!

Founded in 2009, XM Forex is one of the world’s largest forex brokers in Asia & Africa in terms of the number of clients & trading volume. The company has already served more than 3.5 million traders in 196 countries from around the world.

XM offers trading in currencies, CFDs on stocks, commodities, precious metals, energies, as well as equity indices & these can be traded on their MT4 & MT5 trading platforms.

XM broker claims to have executed 99.35% of transactions in less than one second, which is really good (we put that to test & orders were fulfilled without rejection). Added to that, they have over 25 secure payment methods for funding & withdrawals.

For this XM Forex review, we signed up with them & traded on their MT4 platform. Let’s find out where they shine & what they can improve on. And should Nigerian traders choose them?

XM Pros

XM Cons

Table of Contents

| Broker Name | XM Group |

| Year Founded | 2009 |

| Website | www.xm.com |

| Address | 12 Richard & Verengaria Street, Araouzos Castle Court, 3rd Floor, 3042, Limassol, Cyprus |

| XM Forex Minimum Deposit | $5 |

| Maximum Leverage | 1:888 (depends on the instrument being traded) |

| Regulation | ASIC (Australia), IFSC (Belize), CySEC (Cyprus) |

| Trading Instruments | CFDs on Commodities, Stocks, Forex, Equity Indices, Precious Metals, Cryptocurrencies, Energies |

| Trading Platforms | MT4 and MT5 for PC, Mac, Web, Android |

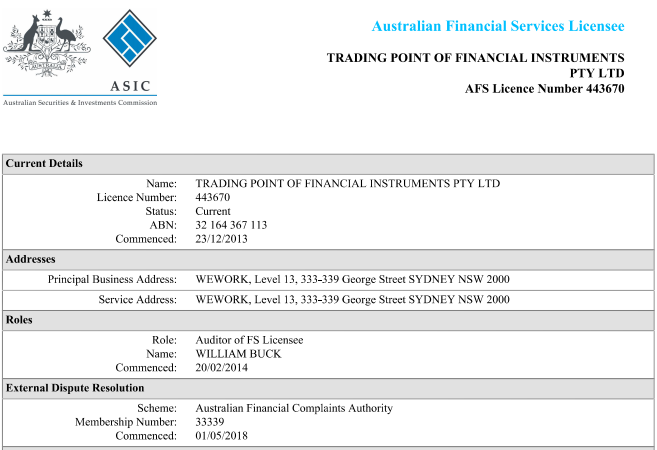

XM is licensed with 2 top-tier regulators around the world. Traders from Nigeria are registered under XM Global (IFSC).

The following are the regulations where XM is regulated.

XM also has negative balance protection, which means that if your balance goes into negative, then XM will roll it to zero. This means that you cannot lose more than your deposited balance.

In terms of regulations, we find XM Forex is trusted since it is regulated with 2 major regulatory authorities ASIC & CySEC, and also because they have been in business for over a decade now.

Fees is really important factor to consider while choosing any forex broker.

XM does not have the lowest spread out of all the regulated forex brokers that we have compared till date, but their spread is still very competitive.

What we like is that there is zero fees on deposits or withdrawals, plus no commission is charged for opening, closing any positions.

Here’s a breakdown of the fees at XM:

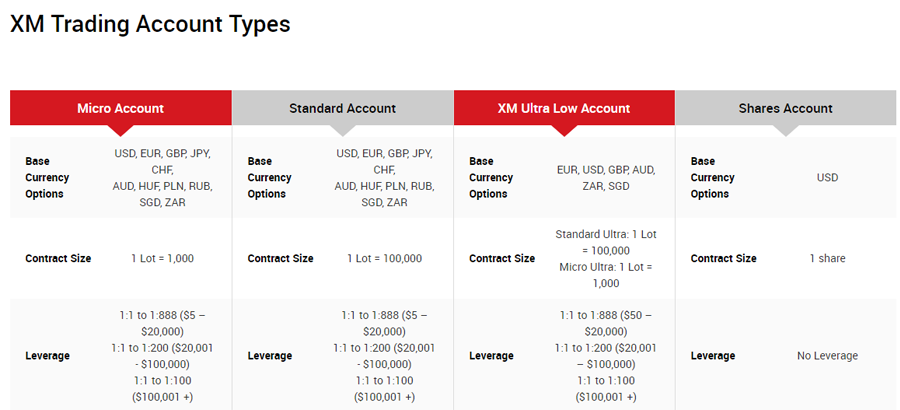

XM offers three trading account types i.e. Micro, Standard & XM Ultra-Low accounts. See our below comparison on where the XM Forex’s 3 Trading accounts differ.

XM Forex has a minimum deposit of $5 for traders in Nigeria. They don’t offer any Naira accounts though.

There are various pros which are available for all 3 accounts. Here’s what we like in XM’s accounts:

Why does it matter? In January 2015, when the Swiss Franc went erratic on the news of interest rate cute during an unscheduled emergency, traders trading on CHF had huge losses & negative balances in their trading accounts. The traders were then asked by their brokers to pay the balance. Negative balance protection offers you safety against your trading balance going into negative.

| Account Type | Micro Account | Standard Account | XM Ultra Low Account |

| Min. Deposit | $5 | $5 | $50 |

| Spread | As low as 1 pip for Majors | 1 pip for major pairs | As low as 0.6 pip |

| Trading Instruments | 55+ Major, Minor & exotic currency pairs, Stocks, Commodities & Cryptocurrencies | same | same |

| Promotions | Two-tier Deposit Bonus upto $5000 | Two-tier bonus upto $5000 | None |

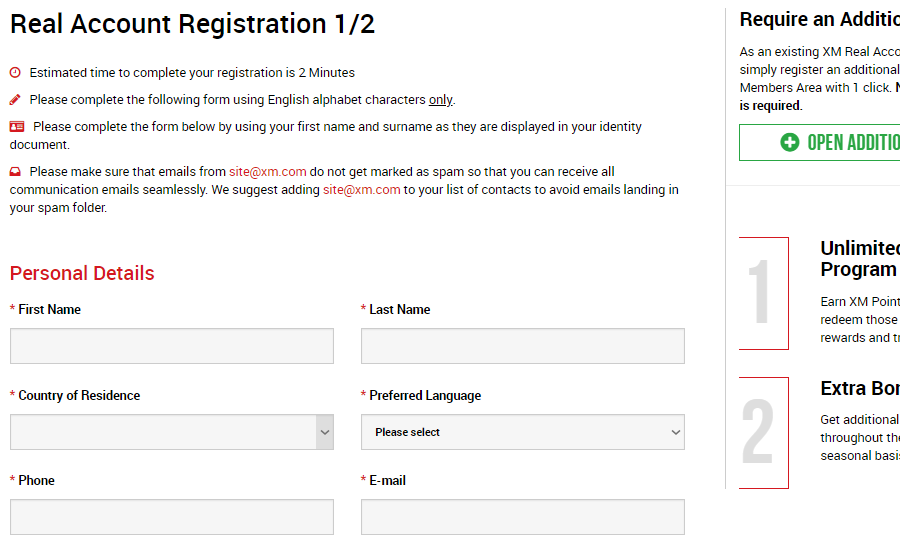

Before starting trading with XM forex you need to open an account with them. For opening an account with XM Forex you need to follow the below-mentioned steps:

Step 1) Open the home page of XM forex and click on Open Account on the top of the page.

Step 2) Now you will be redirected to “Real Account Registration ½” page where you need to fill in some personal details as mentioned below screenshot.

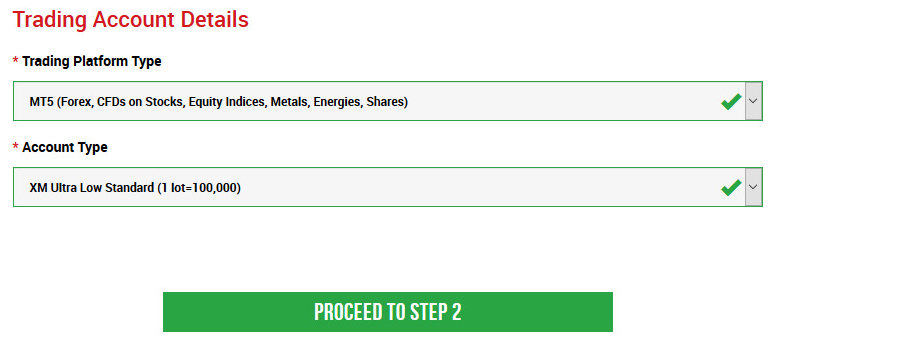

Step 3) Scroll down to the page where you need to select the following under “Trading Account Details”:

Step 4) After entering all the details you need to click on “Proceed to Step 2” button.

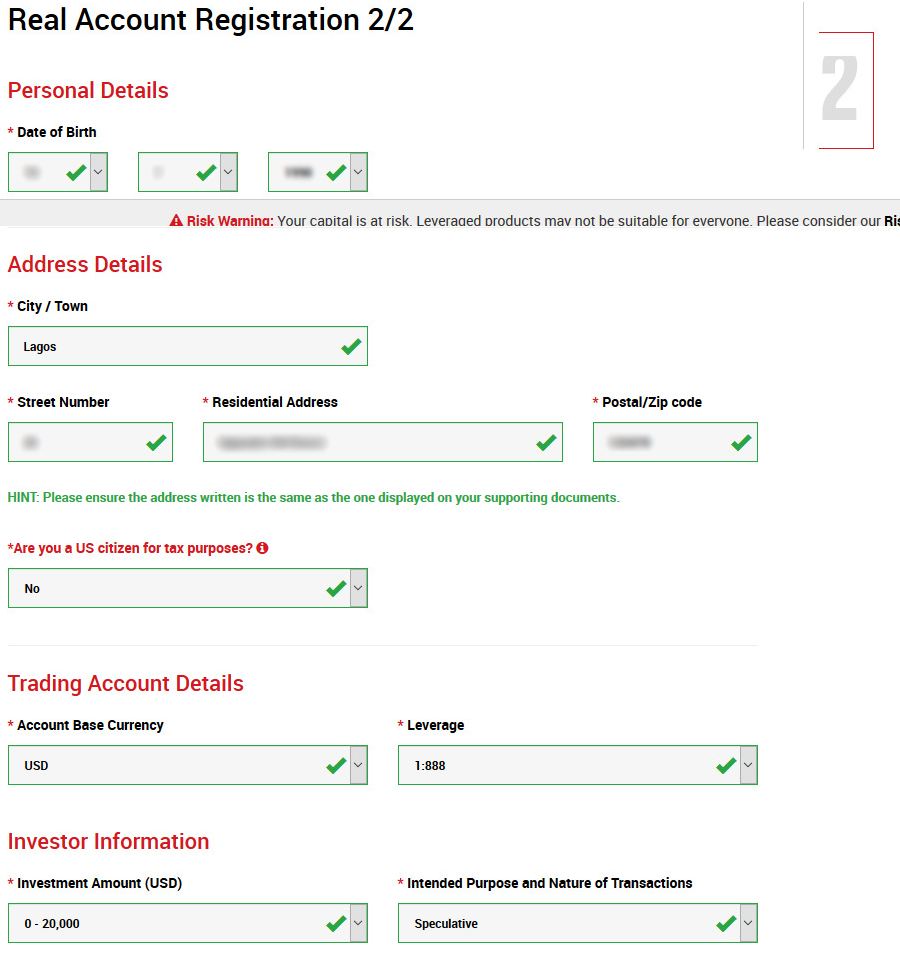

Step 5) Now you are in “Real Account Registration 2/2” where you need to enter your details and set the account password.

Step 6) Once done with entering your all details and settings password you need to click on “OPEN A REAL ACCOUNT” button.

Congratulations! Your account has been set up and you can see the account opening message on the screen.

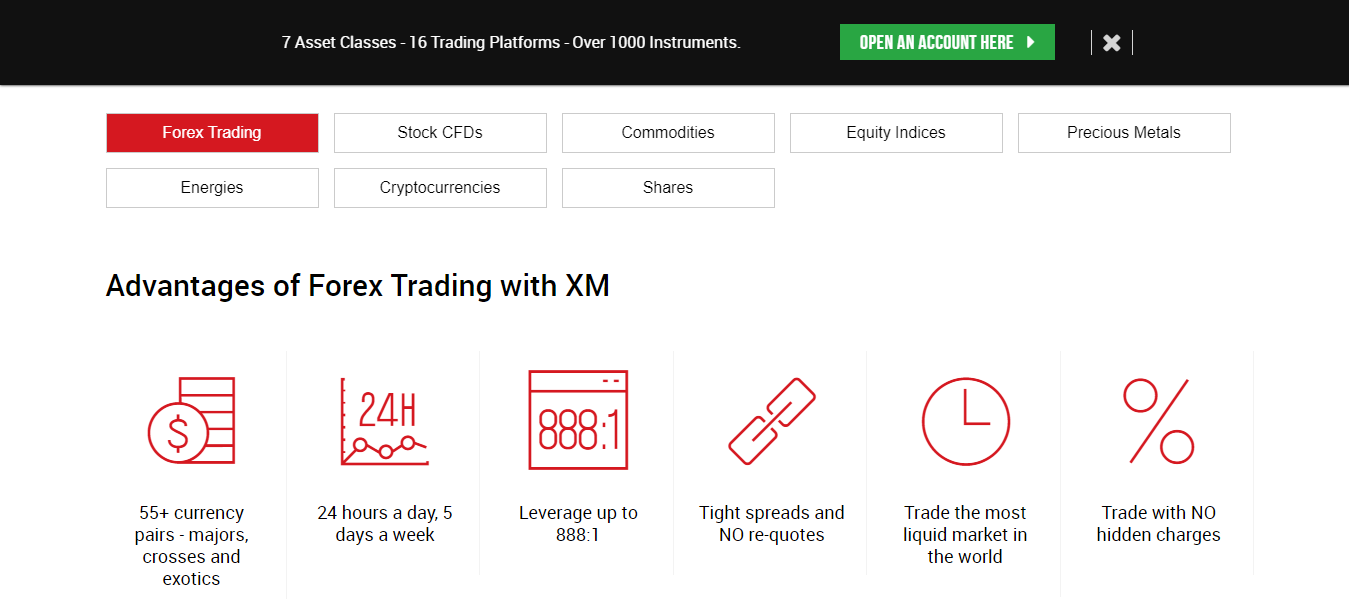

XM offers its users the ability to trade CFDs in stocks, commodities, forex, equity indices, precious metals, cryptocurrencies as well as energies.

The key highlights of these investment options are given below:

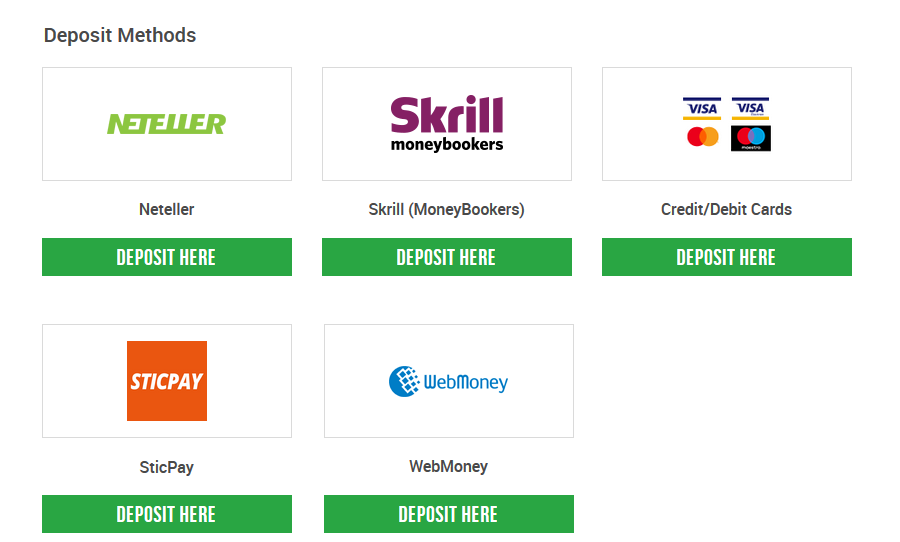

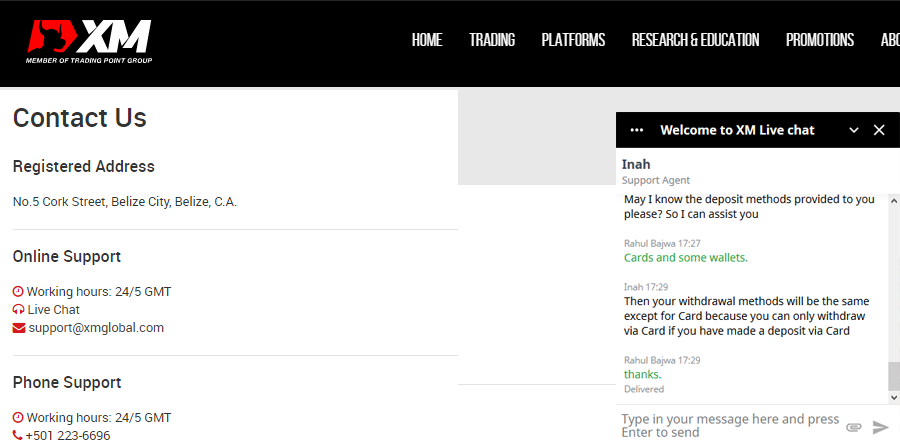

XM has multiple deposits and withdrawals methods for traders in Nigeria. But there is no local bank transfer option.

There is no fees on deposits and withdrawals. The minimum deposit is $5, but there is no limit on the maximum amount on deposits.

The minimum deposit is $5. There are zero fees on deposit and the deposit process is quick, takes less than a few minutes for funding.

The deposit methods include:

1) Credit/Debit Cards: You can use VISA Card, Mastercard Card, or Verve Card to add funds to your account.

2) EWallets: You can also fund using 3 international wallets i.e. Webmoney, Neteller & Skrill. The funding is instant with no transaction charges.

XM has a minimum deposit of around 6000 NGN for all their trading accounts. But this deposit may be different for different payment methods.

For example, if you are using bank account, the deposit required may be higher than in case of wallets.

No, XM does not support Naira accounts. Nigerian traders can open account in USD, EUR or GBP. There are a few other base currency options as well, but those would not be suited for local traders.

Traders who prefer NGN accounts can alternatively look at HFM or Exness, as these brokers have NGN base currency accounts available for all their account types.

Withdrawal methods will be visible to you in your XM members area once you have validated your account. And these methods may vary according to your region.

Here are the withdrawal methods:

Wire Transfer: This method directly transfers your requested withdrawal amount to your bank account without any additional charges. It can take a few days to receive the amount depending on your bank. Your bank may also charge you up to $20-50 for receiving the wire.

EWallets: You can withdraw your amount to your online wallets like webmoney, Skrill, and neteller. There are no charges and the withdrawal with this method takes a few minutes.

Yes, XM does offer bank wire withdrawal option in Nigeria. But note that there may be some fees involved when you request a wire transfer.

Also, they don’t have local bank transfer withdrawal option available.

XM offers its users a range of promotional schemes as well as bonuses in order to attract them. The following bonus & promotions are available at XM currently:

1. Two tier bonus: XM currently has an ongoing two-tier deposit bonus, which gives you 50% deposit bonus up to $500 and 20% bonus up to $5,000.

The bonus crediting process is instant and takes place automatically when you register an account with the website. In addition to this, this bonus promo is applicable to MetaTrader 4 as well as MetaTrader 5 platforms.

2. Free VPS: XM offers Free VPS to its client who has added a balance of USD 5,000 provided they trade at least 5 round turn standard lots per month. Or if you don’t meet these requirements then you can order VPS from their client panel for $28/month. Their VPS allows traders to execute their trades in a timely and efficient manner. This makes their services accessible from anywhere, and they help users in reducing downtime.

XM offers support via 3 methods, like most other brokers. Overall we found their support to be helpful & prompt when we needed their assistance.

1. Email Support is fair: The easiest way to contact XM Forex is via email. You can drop an email to their email support[at]xmglobal[dot]com for any query. They normally reply within a few hours during weekdays.

2. Good Chat Support: Live Chat Support is available 24 hours at XM. We have found their live support to be very quick & also knowledgeable with almost no hold time.

3. Phone Support: XM does not have any local phone number in Nigeria. But you can contact them 24/5 with their team on their international phone number.

Yes, we do recommend XM forex broker to Nigeria based traders. To sum up, XM is one of the best brokers in the business.

XM’s range of accounts with very low minimum deposit requirements, quick order execution, low fees with Ultra-Low Account, as well as its fast withdrawals is its biggest plus points.

We also like the fact that they are highly regulated with ASIC & CySEC. They even have MT5 platform for mobile & web.

But XM, could do better by having a local office or phone in Nigeria. Although, this should not be a big deterrent if you want to trade with XM.

Fast order execution, competitive spreads with Ultra-Low account without any extra commission, good chat support, we couldn’t recommend XM more.

XM is a market maker forex broker that offers floating spread accounts. They don’t offer any ECN type accounts.

XM is not regulated in Nigeria. They are registered with 2 Top-tier regulations ASIC & CySEC. But traders from Nigeria are registered under their Offshore regulation.

The minimum deposit with XM is $5 with their Micro, Standard & Ultra Low Trading accounts. XM does not offer Naira (NGN base currency) trading account to Nigerian traders.

"Do you have experience with XM Forex? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow Nigerian Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Submit Your Review