HFM is one of the best Forex Broker in Nigeria right now. They have really low spread, are well regulated with multiple regulators including FCA & FSCA, have very good support, local funding/withdrawal options, plus mobile trading is also available with them. Read our full HotForex review to find why you should trade with them (and reasons not to)!

HFM is a Forex & CFD broker that was founded in 2010 & is quite popular in Nigeria. HFM has local offices & phone number for support in Nigeria. They claim to have registered more than 2.5 million Live Trading accounts around the world since the start of their operations.

HFM is a well regulated broker (regulated by Top-tier regulators FCA, CySEC, FSCA), so we consider it very safe to deposit funds & trade with them for traders in Nigeria. They serve both retail as well as Profession traders, offering more than 1000+ asset choices including forex trading, and CFDs on commodities, energies, metals, popular stocks, and indices.

In our comprehensive HFM review we look into this broker’s account types, their trading fees, platform, ease of deposit & withdrawals, customer support, their bonus offerings & lot more.

Let’s get started.

HFM Pros

HFM Cons

Table of Contents

| Broker Name | HFM Nigeria |

| Year Founded | 2010 |

| HFM Website | www.hfm.com |

| Address | HF Markets (SV) Ltd., Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont, Kingstown, St. Vincent and the Grenadines |

| HFM Minimum Deposit | $5 |

| Maximum Leverage | 1:1000 |

| Regulation | SV (St. Vincent & the Grenadine), FCA (UK), DFSA (Dubai), FSCA (South Africa), FSA (Seychelles) |

| Trading Instruments | Forex, Crypto Currencies, Metals, Indices, Shares, Energies, Commodities, Bonds |

| Trading Platforms | HFM MT4 and MT5 for PC, Mac, Web, Android |

| HFM Bonus | 100% deposit bonus for new clients |

HFM is regulated and licensed with top-tier Regulatory authorities in United Kingdom, Cyprus, South Africa, St. Vincent & The Grenadine and Seychelles.

It is important to note that Nigeria based clients on HFM are registered under HF Markets (SV) Ltd, which is an offshore regulation.

HFM Group are regulated with following regulators:

Although the traders are registered under their offshore regulation, but the fact that their parent company is well regulated makes HFM a low risk Broker.

The company has acquired a license for commercial, financial, lending, borrowing, trading, service activities and the participation in other enterprises as well as to provide brokerage, training and managed account services in currencies, commodities, indexes, CFDs and leveraged financial instruments.

Customer funds that are deposited on their website are secured, as the company is regulated by multiple Top-tier market regulators in multiple regions. Moreover, HFM also provides insurance cover in case of any security incidents in terms of client funds.

All these features make HFM’s trading platform a safe and secure one. As per our research, the safety and security features offered by HFM are among the best out of the compared CFD brokers in Nigeria.

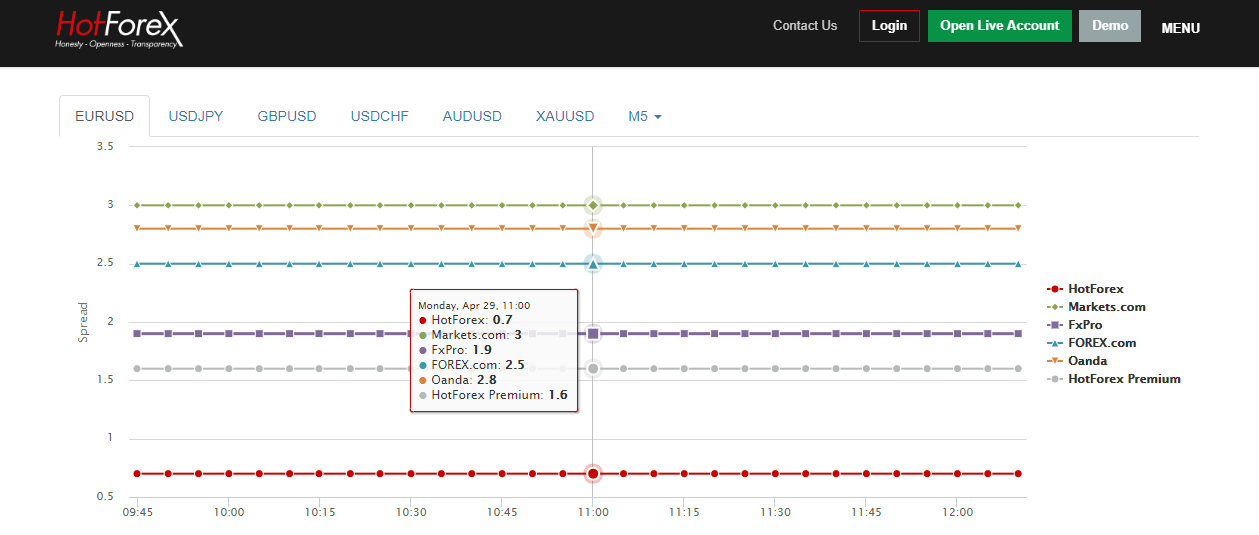

While looking into the spread isn’t everything, it is also really important to research if the broker charges any hidden fees. Some brokers charge extra hidden fees in the name of funds processing charges, annual fees etc. And we like to break this down as well.

During our research, we found HFM has the lowest fees on Forex Trading of all the regulated brokers in the market.

Here’s a breakdown of the fees at HFM

Also, their Swap fees is moderate. For example, major like EUR/USD, their Swap Fees is -3.00 USD for Short & -3.10 USD for Long positions. Comparably, Exness broker have lower swap fees.

We have found that HFM offers one of the lowest spread out of all the well Regulated Forex brokers operating in Nigeria. We recommend them to Nigerian traders in terms of their overall fees, if you are signing up with Zero Account.

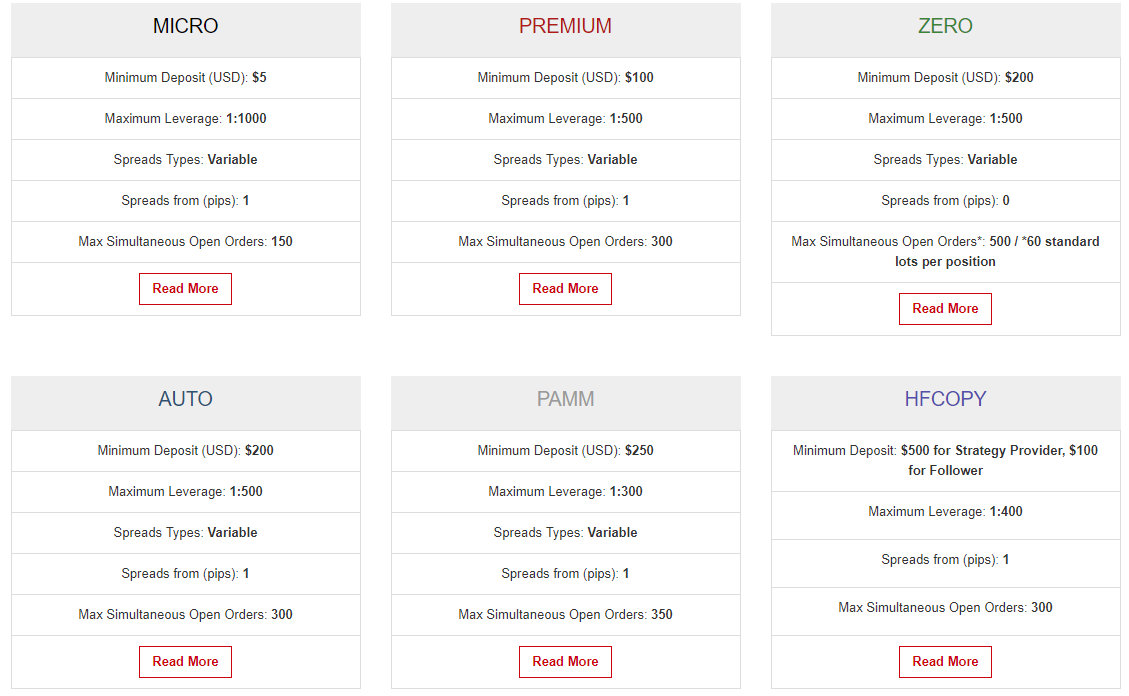

HFM offers a wide range of account types to its customers. There are six major accounts offered by the company: Micro, Premium, Zero, Auto, PAMM, and HFCopy.

The minimum deposit at HFM is $5 for traders based in Nigeria. It is around NGN 2000 for Naira accounts.

Here are the features with all the account types at HFM:

1. Naira Accounts: Nigerian traders can open Naira accounts with HFM, by choosing NGN as your base currency. You can also choose USD or EUR as your base currency besides Nigerian Nairas.

2. Market Execution: HFM claims that they are a 100% STP broker, so all the orders are processed directly in the Live market with no interference or manipulation by the broker for any order, without any re-quotes. But on the downside there may be slippage, but we found it to be is very rare with HFM.

We have found their execution to be really fast, but some other brokers like XM offer instant exeution.

3) Negative Balance protection: HFM offers Negative balance protection. In event of very high volatility in the markets, your account balance may go into negative (if you are not using stop loss). If your account balance goes into negative, HFM will adjust it to zero so that you don’t have to bear the extra loss!

Here’s an overview of all the Live account types that are available at HFM:

Overall, we have found HFM’s account types to be very good with features like Naira account & Negative balance protection. They trade execution is also really fast. For new Nigerian traders, we recommend to start Premium account as you will get really low spread with it & can even get welcome bonus.

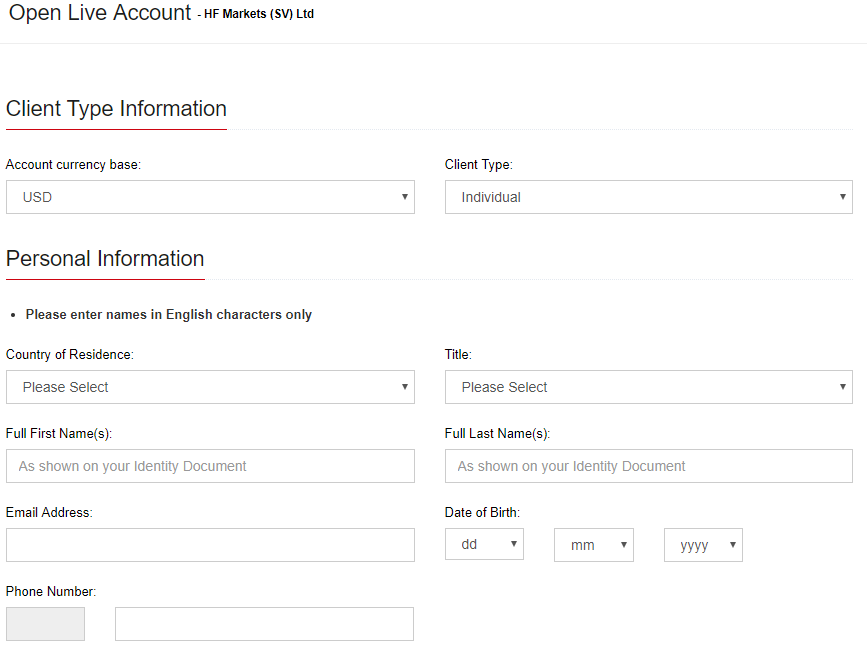

Hotforex accepts Nigerian customers & you can open Naira accounts. Opening an Account with them is standard & straightforward like any other broker. We signed up for their Premium account (low spread & good execution).

You will have to go through the following steps:

Step 1) Compare all the Live account types & then choose the account that you want to start trading with. We recommend you to open Premium Account type at HFM.

After selecting your account, click Open Account which will take you to the Sign Up page. You will be asked to “choose your base currency” (you can select from USD, EUR or NGN). Then you will need to fill your basic Personal Information i.e. Your Full Name, Email, Country of Residence & Birth date.

Step 2) Confirm your email: Once you have registered your account, your will receive an activation Email. Click on the “Activate Now” link in that email. This will complete your basic registration.

Step 3) Fill up the KYC questions: To fully activate your account with HFM, you need to login to your Customer panel & there you need to fill a form with some basic KYC questions.

Step 4) Upload your ID & Address proof for verification: After filling the form, upload your ID proof & your Address Proof documents. For your ID you can upload a scanned copy of your passport, or your driver’s license or any other national ID). For proof you Address you can submit a recent (not older than 6 months) scanned copy of Bank Statement or any Utility Bill.

That’s it. Once you have submitted these documents, HFM will verify your account within 24-48 business hours. After your account is verified your account, only then you can make your first deposit to start trading.

HFM broker has a very easy to use Metatrader 4 & MT5 trading platforms, which we consider to be a pro. HFM have web trading, desktop terminal as well as mobile trading available.

Traders who prefer to trade with mobile can access their mobile app (iPhone and Android). Plus, HFM has multi-device MT4 & MT5 platforms, which comes with charting tools for easy Technical analysis.

But in general, we don’t put too much emphasis on trading platforms, given the fast that almost all the regulated brokers out there have Metatrader web & mobile platforms available. We find it very easy to trade on Metatrader platforms at HFM.

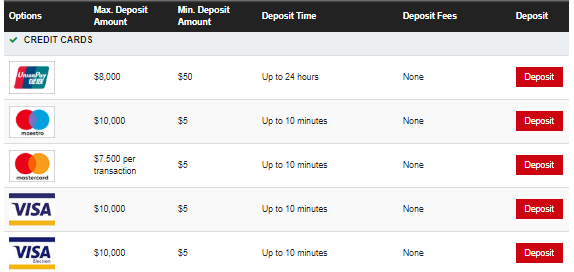

HFM offers a range of different options in terms of deposit and withdrawal methods. The good thing about their funding/withdrawal methods is that HFM charges no fees on deposits & withdrawals. Let’s look deeper into it.

First, let us analyse the deposit methods. HFM normally credit the deposited amount in your trading account very fast without any delays.

Now coming to the withdrawal methods, HFM offers a range of options to its customers. You should note that you can only request the withdrawal to your source funding method.

The withdrawals at HFM are a bit slow but we have found no complaints in this regard from any users. The following are the withdrawal options available for Nigerian traders.

As per our research, the company’s deposit and withdrawal methods are good, and they even support local bank transfers (but they are little slower than some other brokers like FXTM).

Overall, we found no complaints in terms of deposits & withdrawals, as they are very genuine in this regard. Also, if there is any claim, they do try to resolve it.

HFM offers significant welcome bonus of up to 100% to all new traders looking to sign up with them. Also, a volume based Loyalty program is available for existing HFM customers.

We found HFM’s bonus is the best out of all the brokers that we have compared so far. We did not find any other regulated broker that offered better welcome bonus to Nigerian traders.

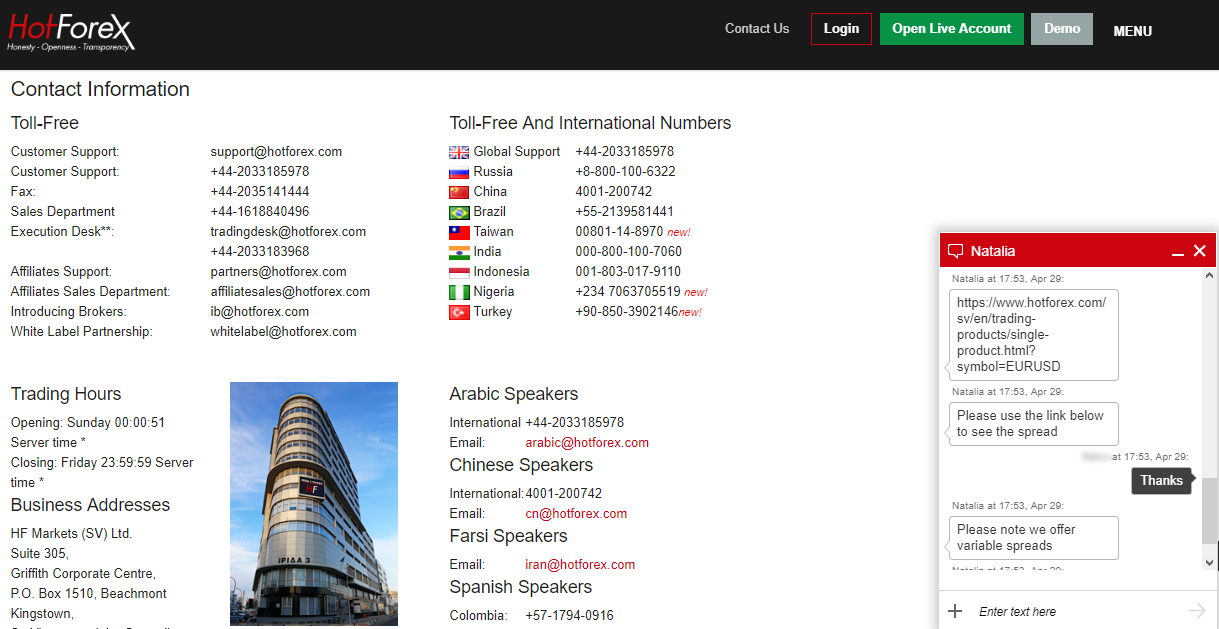

HFM’s support is quick, easily reachable & available 24/5 in English for Nigerian traders.

We tested their support & here is what we found:

Customer support at HFM is definitely good. For fastest response time, we suggest to use the live chat on their website. You can talk to their support at any time during the week days & expect prompt response.

Yes, we highly recommend HFM if you are looking for a moderate spread & well regulated forex broker in Nigeria that offers very good support.

Moderate fees, highly regulated (with FCA, FSCA & more), quick local deposit/withdrawals, solid support, we couldn’t as for more!

Moreover, their wide range of trading instruments i.e. forex, CFDs on commodities & more to its customers. The Naira accounts at HFM come with very great features that offer nice addition for Nigerian traders.

Their 100% welcome deposit bonus offer is almost un-matched.

Overall, HFM is the #2 Forex broker in Nigeria according to our reviews.

HFM is regulated by multiple Tier-1 & Tier-2 regulators including FCA, FSCA & CySEC. So they are considered a relatively safe forex & broker for traders in Nigeria.

HotForex or HFM is not licensed by any regulatory intuition in Nigeria. They are operating any license, and when you open you account, it is under “HF Markets (SV) Ltd”, which is an offshore entity. All your trades are being placed with this foreign entity, registered under the laws of St. Vincent & the Grenadines.

But this does not imply that HFM is illegal in Nigeria, because there is no legal notice on this as such (or regulation related to forex trading). But it does mean that you are trading with HFM at your own risk.

HFM claim to be a NDD & STP CFD broker, with market execution with all account types. So, they are not a market maker broker.

The withdrawal time depends on the method of your withdrawal. Normally, the local bank transfer withdrawals in Naira are processed in 24 hours or the same day. They withdrawal via E-wallets can take a few hours.

HFM has a minimum deposit of $5 with Micro account. They also offer Naira accounts and the minimum deposit in NGN is equivalent to the amount in USD for that account type.

20

"Do you have experience with HF Markets (Hotforex)? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow Nigerian Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

I’ve been trying to figure out which broker to open real trading account with, I traded a demo account with several brokers for over 6-8 months without thinking of opening a real account, but as soon as I came across hotforex, I instantly knew that I’ve found the right broker. Thanks for choosing Nigeria .

4444

My trading career comprised of trading with Hotforex since 2019 start and it is almost one year now. I am happy with the services and I do recommend them being so nice.

55555

I have been trading for past one year now and i can safely say that the pairs offered for trading are reasonable enough to choose the right profitable pair among them. The spreads are fairly reasonable on major pairs. I still count myself as a developing trader so i am only sticking to major pairs for at least one year more. I avoid the CHF one because it is much volatile as compared to others. EUR and GBP are good options for making reasonable pips. WIthdrawals does not have much hassles but i try at least one profit withdraw every five days. It is easy too. Server execution is also moderate with no glitches.

55555

Speaking of fees, there are no fees upon withdrawals and deposits, process of payments is really fast, but its worth noting, one must (should) get verified before any deposits, they can be a bit strict with documents which i think its a good thing.

5

I have been trading with this broker about 1 year and been around on majors as Cable. This broker really offers tight spreads for Premium account (zero commision) but if you want raw spread, just accept commission about < $1/lot with their zero spread account but I truly recommend Premium or Fixed spread account types for new traders. You can always get withdrawal requests processed within 24 hours. Really swift and easy-to-use platform. Highly recommend!

5

According to my own trading experience with Hotforex. I had found out that it is honest broker with which I am trading for years now and i had noticed many improvements since i joined them.

5

very satisfied with their services, excellent support and very responsive.. I made 2 withdrawals all processed with ease, very good trading conditions, fast executions and platform stability is top notch. i dont know what to add, i hope they continue to excel

55555

hotforex is very good, they are providing great trading conditions for traders, with a competitive spread on forex, a good number of cdfs and cypto to trade as well. metals is another option that is very popular. and withdrawals are really easy and almost with in 24 hrs.

5

I was introduced to hotforex through an IB, and I am very pleased with how things turned out, excellent broker, tight spreads, fast execution and they even offer crypto trading. usually withdrawals take less than 48 hrs through epayments which is very convenient.

5