There are various financial instruments available for Nigerians that can be used to earn profits and build your wealth. However, it is critical to choose the right instrument which is the most suitable for you.

Investing in the right instrument at the right time could not only ensure healthy profits for you but could also help you in maximizing your savings.

One of the most popularly traded instruments is currencies. Currency trading has been around for centuries, and it is one of the most common instruments used by small as well as large traders.

Before making the decision to invest in foreign exchange (forex), it is important to grasp the nuances of forex trading.

5 Steps to Trade Forex for beginners in Nigeria

Forex trading essentially refers to the over-the-counter market where traders can exchange currencies. The mechanics of forex trading are very similar to other instruments such as stocks.

You just need to analyze the market conditions and then buy or sell a currency with the expectation that it will rise or fall in price. Once the desired price points have been reached, you can simply sell or buy the currency to realize your profits.

Apart from traders, major companies, governments, banks, private investors, as well as other entities trade in the forex market everyday. Trading activities in the forex market can be conducted 24 hours a day from Mondays to Fridays.

It is worth noting that the trading volume of forex markets is much more than all the stock markets in the world put together. In addition to this, the forex market is one of the best mediums to generate extra income in order to maximize your wealth.

One of the biggest advantage of the forex market is that you have a wide range of currencies to choose from. The range of currencies includes the US Dollar, the Euro, the British Pound, the Yen, etc.

Let’s take a look further..

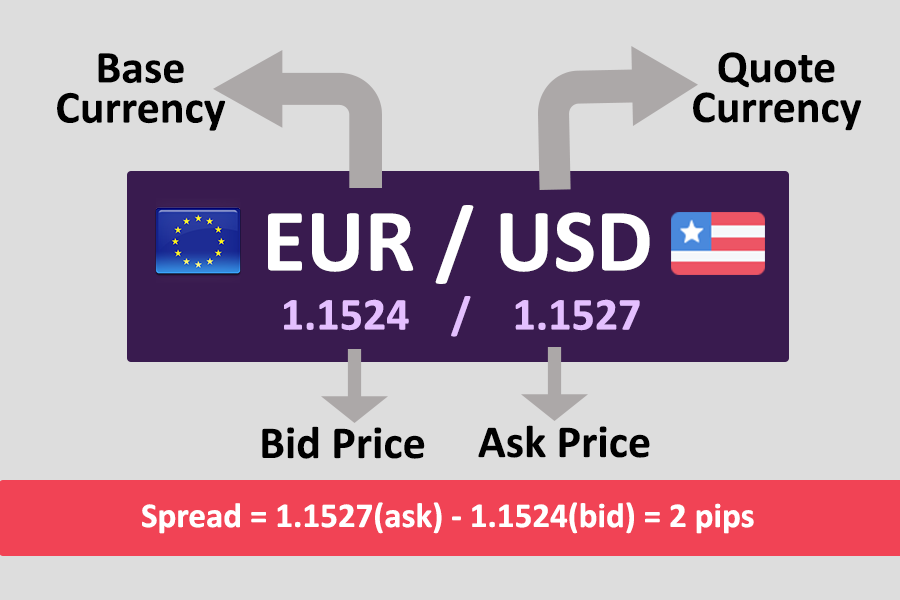

It is important to understand that forex trading works in pairs. This means that one currency is bought or sold in exchange for a second currency.

There are mainly 2 trading strategies namely Fundamental and Technical. Let’s find out what they really are.

The fundamental analysis makes use of monitoring the basic indicators of the different countries and then figuring out the best currency pair on the basis of your analysis.

You could make use of a wide range of criteria such as trading positions, GDP, GDP growth rate, political climate, as well as the trade situation of a country. After comparing the figures as well as the current situation prevailing in different pairs of countries, you can make your decision to invest in currency.

The basic idea behind the fundamental analysis is to build a grip on the market and to ensure that you maximize the return on your investment based on your analysis of the economic environment of the country. Fundamental analysis is a technique that is used commonly by a large number of traders around the world. This kind of analysis is relatively simple to carry out and can prove to be extremely beneficial in shaping your investment decisions in terms of forex.

On the other hand, the technical analysis makes use of charts that show the past performance of currencies. The technical analysis could help you in identifying the key trends that are forming in the chart, and you could then make your prediction for the currency based on that chart.

It has been noted that in many cases, the historical data pertaining to currency can prove to be crucial in predicting future trends. You could easily obtain such historical price charts from your broker.

Typically, brokers make use of advanced technology-based platforms to provide you with such charts. One such platform is the MetaTrader platform.

Metatrader is an advanced platform that not only allows you to view and analyze currency trends in the form of technical charts but also allows you to execute your trades online. Further, such platforms can also help you by providing you with technical analysis reports on a regular basis. Such reports can help you in choosing the right currency and booking your profits.

To trade forex you need a broker that would accept/execute your orders in the forex market. There are various brokers in the market that are regulated and authorized by the relevant authorities around the world.

We have done the reasearch for you & listed the best forex brokers for Nigerians including the well-known brands like FXTM, HotForex, XM Forex and Alpari. These brokers offer low fees & range of platforms that can simplify the forex trading for you.

Most forex brokers allow you to create standard or ECN accounts and then place trades in the Interbank market through their platforms. Right after the creation of an account, you need to make a deposit in your account with the broker. After this, you will be using your deposited funds to conduct trades.

You need to pick the most suitable broker for yourself based on your own suitability. However, there are certain guidelines that you can follow to choose the right broker for you.

There are various aspects of a broker that you need to analyze before making your choice.

The first thing to determine while placing your trade is whether you wish to buy or sell the currency. Most brokers tend to quote all their offered currency pairs on a single platform. You can make use of the platform to choose which currency you want to trade in as well as whether you wish to buy or sell.

Further, there are two types of Stop Loss orders, standard and guaranteed. The Standard Stop Loss stands for closing the trade at the best available price. However, there is a risk of further loss if there is a gap in market prices. On the other hand, the Guaranteed Stop Loss ensures that the trade is stopped at the exact level that you have instructed so that there are no further losses.

Typically, the Guaranteed Stop Loss has a premium attached to it. Finally, a Limit Order is an instruction to close the trade at a price that is above the current market level. All these orders help you in minimizing your trading risk and protecting your wealth.

Closing your trade simply means that the currency pairs that you bought or sold as part of the original transaction need to be sold off.

For example, if you bought a currency pair initially, you need to sell off an equal number of the same pair. By closing your trade, you can immediately realize your profit or loss.

Thereafter, this profit or loss is immediately visible in your account cash balance. Thus, it is very important to understand when to stop trading on a pair and when to book your profits. There are many traders who make the mistake of continuing to trade even after they have realized high profits. This can prove to be a dangerous strategy, and you need to know when to stop.

To sum up, it is evident that the forex market presents a great opportunity for anyone to make money. In addition, the range of currencies that are available allow traders with ample opportunities to book profits and to build their wealth. In order to achieve this, the key is to choose the right broker and to get a grip on the market.

You can build an in-depth understanding of the forex market by experimenting on demo, making use of fundamental as well as technical analysis. Once you have an idea about the currencies, you can place your trade and eventually book your profits (or loss). The forex market can prove to be a wonderful opportunity to exploit the currency movements and to realize gains on a regular basis.

2021's Best FX Brokers

See Rank