Learn to trade Bitcoin in Nigeria in 5 easy Steps. Also, see the Best Bitcoin Trading Platforms.

All those seeking to trade Bitcoin in Nigeria have 2 options. One way is to purchase BTC for Naira directly via a Crypto exchange & store it in a Bitcoin wallet. Alternatively, you can trade & speculate on Bitcoin as a CFD trading instrument with foreign regulated Forex brokers like HotForex, Plus500, Avatrade etc.

In this guide, we have detailed the steps for trading Bitcoin as a CFD through reputed Forex brokers. There are multiple brokers that offer Bitcoin trading to traders in Nigeria, where you can speculate on BTC/USD etc.

You can also trade other Cryptos like Ethreum and speculate on the market fluctuations in Cryptocurrencies.

Here are the simple Steps to Trade Bitcoin in Nigeria:

While selecting a Bitcoin trading broker, you must ensure that the broker offers a trading platform that is easy to use. They must also offer tools for analysis and Mobile apps for your Bitcoin trade.

Trading Bitcoin involves purchasing at low price and sale at high. It is unlike investing wherein you hold Bitcoin for a long period. In trading, you attempt to forecast price movements through overall analysis of the market and particularly price graphs.

We have explained each step involved in Bitcoin Trading as a CFD for Nigerian traders.

You can trade BTC in the form of CFD. In this type of Bitcoin trade, you do not hold actual Bitcoin.

You are only speculating on the price of BTC i.e. if you believe the Bitcoin is going to increase in value against US Dollar then you can place a ‘Buy order’ on BTC/USD & vice versa.

As a trader in Nigeria, you can trade BTC as a CFD instrument via any broker that offers Crypto Trading. You will have to open a Trading Account with a CFD Broker that offers Cryptocurrencies. There a few globally regulated Brokers that offer Bitcoin trading.

You can trade Bitcoin against fiat currency like the US Dollar i.e. BTC/USD pair. You can also trade against other Cryptos like Ripple, Ethereum, or Litecoin like ETH/BTC. These Crypto crosses are offered by Brokers like Plus500 & Avatrade. These CFD Brokers usually also offer leverage. It is limited to 1:2 or 1:5 maximum in the case of Cryptos.

Let us now briefly understand some of the common terminologies in Bitcoin trading:

The Bitcoin price refers to the price of the last trade held through a particular trading platform. It is a crucial point of difference. This occurs as there is no single Bitcoin exchange globally.

The price of Bitcoin in certain nations for instance can differ from its price in the Nigeria. This is as the major exchanges in these nations include diverse trades.

You will also sometimes see the terms low and high next to the price. They refer to the lowest and highest prices of Bitcoin in the past 24 hours.

Here is an example of a Bitcoin Chart from 2014-2020.

As an example, The chart shows that Bitcoin price rose or rallied from around $750 per BTC at start of 2017 to almost $19,000 by end of 2017.

Volume denotes the number of total Bitcoins traded in a given timeframe. It is used by traders for identifying the significance of a trend, and market sentiment. Major trends are normally accompanied by large volumes of trade. Meanwhile, low volumes accompany weak trends.

For instance, high volumes will accompany a healthy upward trend when price increases. Volumes will be low when the price decreases.

You may at times witness abrupt fluctuations in the price. Then, Market Experts advise to check the significance of the trading volume. This is to determine if it is only a minor correction or commencement of a reverse trend.

This chart by CoinMarketCap shows the daily volume & price of Bitcoin against the US Dollar

The price at which buyers are prepared to purchase the BTC/USD or BTC/ETH pair is the Bid price. The price at which sellers are prepared for the sale of these pairs is the Ask price.

Leverage is the multiplier at which you are allowed trading than permitted by your initial funds for trade. It is represented through a ratio. The examples of leverage ratios offered by CFD Brokers are 1:10, 1:30, or 1: 50.

If you are using 1:10 Leverage, it means you can trade $100 worth of Bitcoin, with $10 of your capital. You can read our guide on Leverage in Forex Trading that explains the concepts & risks of Leverage.

The cost of the trade/transaction which is charged by the Broker is denoted by the spread. It is the difference between the ‘bid’ and ‘ask’ price of a specific pair of BTC and Fiat Currency or Cryptocurrency.

Consider a trade transaction with the bid price as 0.99999 and ask price as 0.99995. It implies that the spread is 0.00004 or 0.04 pips. Most of the Broker trading platforms will highlight it upfront for each pair like BTC/USD or BTC/ETH.

The movement of the rate of exchange is measured via Pip. It is the unit to determine if you have incurred loss or profit on an exchange. The value of each pip unit corresponds to 0.0001.

Below are some examples of how the term is used in a context:

‘The BTC/USD gained 10 pips in the past 8 hours’

‘I made 20 pips on my BTC trade yesterday’

A pip always has a corresponding value in currency. This determines your actual loss or profit in fiscal terms.

You must select a renowned platform offering CFD trading on Cryptos. They must be regulated with several Top-Tier 1 and 2 Regulators like FCA, ASIC, CYSEC, and FSCA.

| Bitcoin Trading Platform | Platform(s) | Devices Available | Max. Leverage | Account minimum | Regulations | Start Trading |

|---|---|---|---|---|---|---|

| Hotforex | MT4, MT5, Webtrader | Desktop, web & mobile | 1:1000 | $5 (₦2300 approx.) | FCA, FSCA, CySEC | Visit Hotforex |

| OctaFX | MT4, MT5, cTrader | Mobile App, Web trader & Desktop app | 1:500 | $100 | CySEC | Visit OctaFX |

| FXTM | MT4, MT5 | Mobile App, Web trader & Desktop app | 1:1000 | ₦2000 | FCA, FSCA | Visit FXTM |

| Avatrade | MT4, MT5 | Mobile App, Web trader & Desktop app | 1:400 | $100 | ASIC, FSCA | Visit Avatrade |

The Broker must offer a robust platform for trading. You must be easily able to conduct technical analysis on it. The platform must also enable you to quickly execute trades with a vast choice of Cryptos at lowest fees.

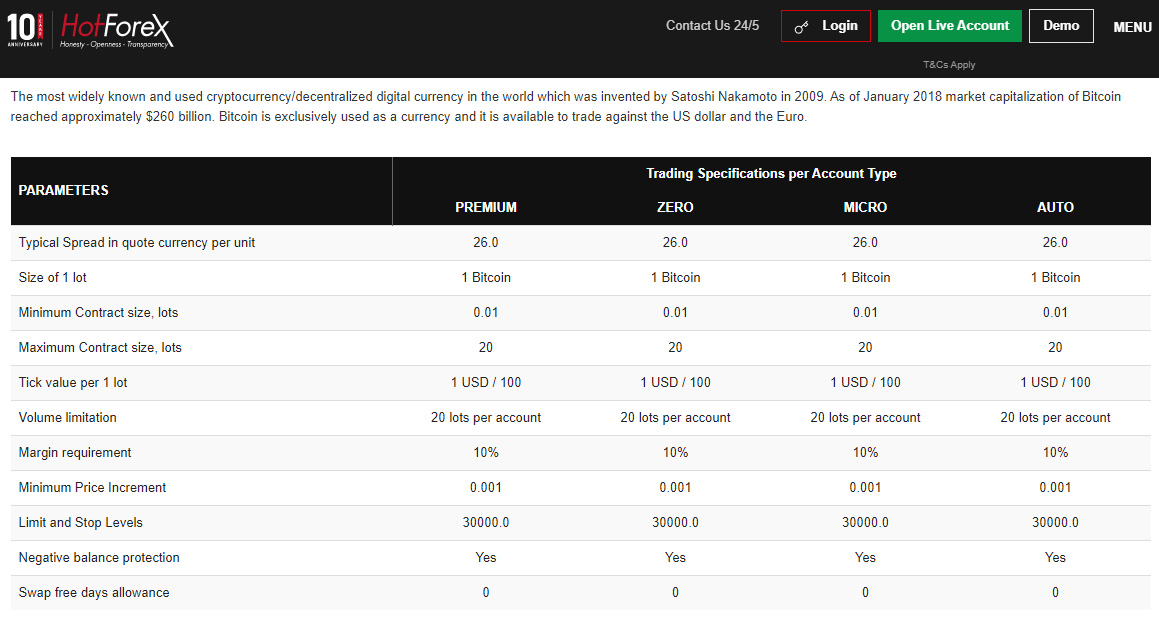

Brokers will generally have a page where they compare their fees, like this page on Hotforex for their BTCUSD trading conditions comparison for different account types.

Moreover, you must be offered access to a web-based or downloadable platform by the Broker. Mobile App access must also be included by them.

The offerings of the Broker must include a Margin Account. It must permit a minimum of 1:10 leverage on the majority of pairs (excluding Cryptos). Their education section must assist you in trading in the dynamic markets. The trading conditions must also not heavily invade on your profits.

Moreover, the Broker must also provide you with a Demo Account. This will permit you to test the platform and trading conditions. It is without risking your actual capital.

While analyzing Bitcoins or any financial instruments, traders usually follow two Trading Strategies or methodologies:

This analysis attempts to forecast the price by looking at the overall scenario. In Bitcoin for instance it includes evaluating the Bitcoin industry, news regarding BTC, and technological advancements like the lightning network. Global regulations and any other issues or news that can impact Bitcoins success are also included.

The fundamental analysis looks at the value of Bitcoin as a technology and the impact of appropriate external forces. It is irrespective of the existing price. Then their impact on the price is analyzed.

For instance, consider that China abruptly decides to ban BTC. The analysis will then forecast a likely price decline.

This analysis attempts to forecast the price by examining market statistics. It includes past trading volumes and price movements. The aim is to identify trends and patterns in the price. The future price patterns are then predicted based on these inferences.

The technical analysis has a core assumption in it. It is that price movement speaks for themselves irrespective of the current global developments. These convey a message that helps in predicting future market price developments.

You will have to place a trade using the platform of the BTC broker that you have chosen. This is after you settle your position.

The amount that you want to stake on your trade must be entered into the deal ticket. You can also define conditions for your closing. It includes setting a stop to close your position when the market moves against you by a specific amount. Also, you can set a limit for it when it moves in your favor.

Limits and Stops are crucial elements of a good risk management strategy for BTC Trading.

You will ‘buy’ the market is you expect that the value of Bitcoin will increase. You will ‘sell’ if you think that it will decrease.

Let us consider the example of BTC trade through CFDs for a popular fiat pairing like BTC/USD. Here you are also speculating on the rise and fall in the pairing’s price.

Now, for instance, you intend to purchase 1 Bitcoins at the BTC/USD price of 10,000.

For opening this trade with a conventional exchange for a position of $10,000 you have to pay $10,000 to your exchange. This excludes any commission or extra charges, although they may also charge 1-2% fees for the exchange.

If the price of Bitcoin goes higher by 5%, the worth of your 1 Bitcoins is now $10,500 each. You will make a profit of $5,00 if you choose to sell. This is from your original investment of $10,000.

1:10 leverage trade

In this scenario, you are required to hold just 10% of your position valued at $10,000 to open the trade. This means just $1,000. You will still incur the same $500 profit if the price of Bitcoin increases by 5%.

This implies that the profits can be multiplied in a leveraged trade. But this also increases your risk of losing all your invested capital if the Bitcoin price goes down by 10% i.e. to $9000

The need to buy BTC is implied by a buy order, so if you want to buy Bitcoin then you can place a buy order on BTCUSD. The need to sell BTC is denoted by a sell order. The sell and buy orders are placed on an order book. These are fulfilled by corresponding buyers with appropriate sellers and vice versa.

It permits you to fix an exact price at which you intend to sell automatically at a future date if the price declines significantly against your trade.

Stop-loss orders are very useful for minimizing your losses. It is essentially an order that conveys the following to the trading platform:

This order functions as a market order. It implies that the market will begin selling your BTC once the stop price is reached. This is at any price until the order is fulfilled.

It permits your sale or purchase of BTC at your fixed decided price. This implies that the order may not be fulfilled completely. It is because there will not be adequate sellers or buyers for fulfilling your requirements.

Let us consider that you place a limit order for the purchase of 5 BTC at $10,000 for each coin. You may then end up possessing 4 BTC only. This is because there were no other sellers ready to sell you the last BTC at $10,000. The remaining order for 1 BTC will stay there. It is until the price again reaches $10,000 and the order gets fulfilled.

You just need to place the reverse of your original trade for closing your position. So, if you purchased originally, you will sell the same amount. You will buy it if you sold originally.

The trading platform will automatically fill your deal ticket with the size of the position. The platform will generally have a ‘Close order’ button that you can use for closing your trade.

For you to decide on closing a trade, it is not always necessary that the trade has to be in profit for you. Minimizing your losses on bad trades is equally crucial as while closing for profitable winning trades.

The mechanics of closing out the trade are the same when the time is right. This is irrespective of the position showing up the loss or a profit.

Generally, you are required to click on your open position, click on ‘Close’ and confirm ‘Close all’. The position of $10,000 BTC will be sold and converted again to your account balance which you can withdraw at any time.

Once you click for closing your position, your account will sell your BTC at the market price. You can then realize your profit or loss from the trade.

Yes, you can trade Bitcoin as a CFD instrument via a forex or CFD broker that accepts clients based in Nigeria. When you are trading Bitcoin as a CFD, you are only speculating on the price of Bitcoin, you don’t own bitcoin.

Tier-1 regulated CFD brokers like HotForex, Exness etc are considered safe for traders who want to trade CFDs on Bitcoin from Nigeria. Avoid any broker that is not regulated by atleast one Top-tier regulator like FCA, ASIC, FSCA or CySEC.

The fees can be 0.4% of the trade (per trade) or above for trading CFDs on Bitcoin. Depending on your CFD broker & your trading account type, this fees can be quite high as well. You should compare the spreads for BTCUSD for the account type at the CFD broker with which you want to trade Bitcoin.

Hotforex is the #1 Bitcoin Platform

Visit