Copy Trading allows retail traders to replicate the trade orders executed the exerts and professional. Forex is a high-risk capital market where most beginners lose money.

The Copy Trading feature offered by the forex brokers allows traders to copy the positions of experienced traders at the expense of a commission.

5 Best Copy Trading Platforms in Nigeria

Copy Trading started around 2010 when select forex brokers provided this feature. Currently, a lot of forex brokers in Nigeria offer this feature.

The probability to make profits in the forex market through copy trading may be higher for the newcomers rather than trading themselves. But you must understand its risks, and always check to ensure that the traders that you are copying have a low risk profile & a long history of good returns.

Following are the details of the best forex copy trading platforms for Nigerian traders.

Ranks #1 Copy Trading platform in Nigeria

HotForex is a renowned and trustworthy forex broker that offers copy trading services in Nigeria. It is regulated by Financial Conduct Authority (FCA) (801701) in the UK and Financial Sector Conduct Authority (FSCA) (46632) in South Africa. The top-tier offshore regulation makes HotForex safe for traders in Nigeria.

Copy trading feature at HotForex is available with the HFcopy account type. MetaTrader 4, Webtrader, and mobile trading platforms can be used to trade with HFcopy account. Traders need to select this account type while opening the account to start copy trading at HotForex in Nigeria. The account can be opened either as Strategy Provider or Follower.

Copy Trading as Strategy Provider (SP)

The HFcopy account of strategy providers is followed by other clients who copy the trades orders of SPs. The strategy provider aims to increase the number of followers by executing profit-making trade orders.

A strategy provider can have a maximum of 400 followers at HotForex and requires a minimum deposit of 500$. SPs don’t need to pay any commission as the spread is the only trading fee. The SPs earn a performance fee that is a fixed percentage of the amount traded by each follower. SPs can decide the performance fee ranging from 1% to 50%.

Copy Trading as a Follower

The followers can follow any of the strategy providers with the HFcopy account type at HotForex. Before copying the trade orders of SPs, they can check the detailed historical performance along with the performance fee of SPs.

The minimum deposit for a follower is 100$ at HotForex with a maximum leverage of 1:400. SPs with better performance history generally charge a higher performance fee. The follower aims to search for the best suited SP with impressive performance history and reasonable performance fee.

Ranks #2 Copy Trading platform in Nigeria

ForexTime Limited, popularly known as FXTM is one of the oldest copy trading forex brokers in Nigeria. It is regulated by FCA (777911) in UK and CySEC (185/12) in European Union. FXTM is considered safe for traders in Nigeria due to top-tier offshore regulations.

FXTM offers a copy trading service on the Metatrader 4 trading platform. Traders can select the best-suited strategy manager from a long list of strategy managers. The historical trades, success rates, AUM managed, profits made, and the performance fee of the strategy manager can be checked before choosing.

FXTM uses automated trading functionality for copy trading. Followers can choose the best-suited traders and trading strategies. All the opened positions and subsequent trade orders are copied. Traders cannot choose to copy individual trade orders at FXTM.

FXTM requires a minimum deposit of 100$ to start copy trading. After selecting the strategy manager under the FXTM Invest section, all the trade orders will be automatically copied. Traders can stop copying anytime they want and can cash out the profits. The predefined percentage of the traded amount will be deducted as performance fees only when there is a profit. This fee gets credited to the account of the strategy manager. FXTM does not incur any other commission for copy trading.

Ranks #3 Copy Trading platform in Nigeria

OctaFX offers a convenient copy trading feature on currency pairs. Traders can either become copiers or master on the Metatrader 4, OctaFX Webtrader, or OctaFX Copytrading Android app.

OctaFX is regulated by CySEC (372/18) in the European Union. Apart from CySEC, it does not hold a regulatory license from any other authority. OctaFX can be considered safe for traders in Nigeria due to the CySEC license but it is a tier 2 regulatory authority. Hence, OctaFX may not be as safe as some of the other copy trading forex brokers in Nigeria.

OctaFX has a separate Copytrading app but that is available only with Android devices. The broker does not charge any commission for copy trading. Only the master trader’s commission is incurred to the copiers. This commission is a fixed percentage that is charged only on the gains made by copying the master. Each master can have a different master trader’s commission.

Traders need to select the amount that will be used in copying the trade orders of the master. Individual trades cannot be copied separately. OctaFX provides detailed stats of each master including commission, currency pairs used by the master, profit probability, past trades, AUM, etc.

A minimum of 0.01 lot can be traded by a copier. The maximum leverage for the copier is 1:500 and the minimum deposit is 25$. The commission for the Master trader can range between 0 to 50% of the profits.

Copy Trading at OctaFX can be comparatively cheaper than many of the other forex brokers in Nigeria. The spreads are low starting from 0.6 pips. The OctaFX Copytrading app makes it a good choice for copy trading in Nigeria.

AvaTrade holds multiple regulatory licenses from top-tier regulatory authorities internationally. It is regulated by ASIC (406684) in Australia, CySEC (347/17) in the EU, and FSCA (45984) in South Africa. Apart from these, it is also regulated in Japan, Ireland, and UAE. This makes AvaTrade considerably safe for traders in Nigeria.

AvaTrade is one of the oldest copy trading service providers and offers 3 different types of copy trading services:

ZuluTrade: It is the basic MetaTrader 4 copy trading feature in which traders or copiers can follow professional traders and all the trade orders are copied. Copiers can choose from more than 10,000 professional traders to follow. A minimum deposit of 500$ is required to start copy trading with ZuluTrade.

DupliTrade: DupliTrade is a copy trading feature ideal for copy traders with more experience. It allows copiers to follow traders and all their trade orders. Additionally, it also allows the copiers to copy trading strategies and choose particular trade orders. DupliTrade is available with MT4 and MT5 trading platforms and requires a minimum deposit of 2000$. There is a limited number of professional traders and strategies to follow. With DupliTrade, traders can copy multiple trade orders from different professional traders.

AvaSocial: This copy trading service grants access to social trading technology where connected peers can discuss trading strategies with the experts. It allows copying trades of experts, mentors, and any connected peers with a single click.

The fees for each of the copy trading service is similar. Apart from spreads, copiers are required to pay the performance fee set by the professional trader. AvaTrade offers multiple types of services in copy trading to suit the needs of different types of copy traders. The minimum deposit requirement is higher than most of the peers but multiple top-tier regulations make it a good choice for Nigerian traders.

FBS offers a simple copy trading service where any of the registered clients can copy another trader that has signed up to be a professional trader to be copied.

FBS is regulated by IFSC (000102/19) in Belize. Apart from this, it is not regulated by any other regulatory authority. The absence of any tier 1 or tier 2 regulatory license makes it comparatively less safe than many brokers for traders in Nigeria.

FBS has a separate copy trading android and iOS application that allows convenient copy trading in Nigeria. The copy trading account gets connected with the main account and all trades of the followed account are copied.

Any trader can also become a professional trader by switching on the copy parameters. A minimum deposit of 100$ is required. The performance commission is decided by the professional trader.

Compared to other copy trading forex brokers in Nigeria, FBS can be cost-effective and convenient but might not be the safest bet.

As the name suggests, copy trading is a feature offered by forex brokers where new or less experienced traders can copy the trade orders of professional or experienced traders. This makes the trading similar to investing but the risk factor remains the same.

Copy trading started in 2005 when the trade orders from experts were copied by followers in a private group. Soon, forex brokers adapted this feature and offered it on their trading platforms.

The majority of the new traders in forex and CFD face losses. Copy trading feature allows beginners to increase their chances of making profits in the initial phase.

Copy trading feature allows copying trade orders of other traders, on instruments including forex and CFDs on Indices, stocks, commodities, cryptocurrencies, etc.

Generally, all brokers which allow copy trading don’t have any separate proceed to open a copy trading account, and you can allocate the balance in your trading account or part of it for copy trading. The cost incurred for copy trading depends mainly on the commission set by the trader you are following and the broker you have chosen. For a safe and productive trading experience, copy traders must spend adequate time and effort in the selection of broker and master trader.

The regulatory licenses held by the broker, spreads, and commission charged should be checked and compared before choosing a broker for copy trading. Before choosing a trader to copy with any of the brokers, clients must check whether their trading strategy is suitable or not.

Each trader takes different risks and trades with different instruments with different strategies. There are metrics which brokers highlight on their platforms.

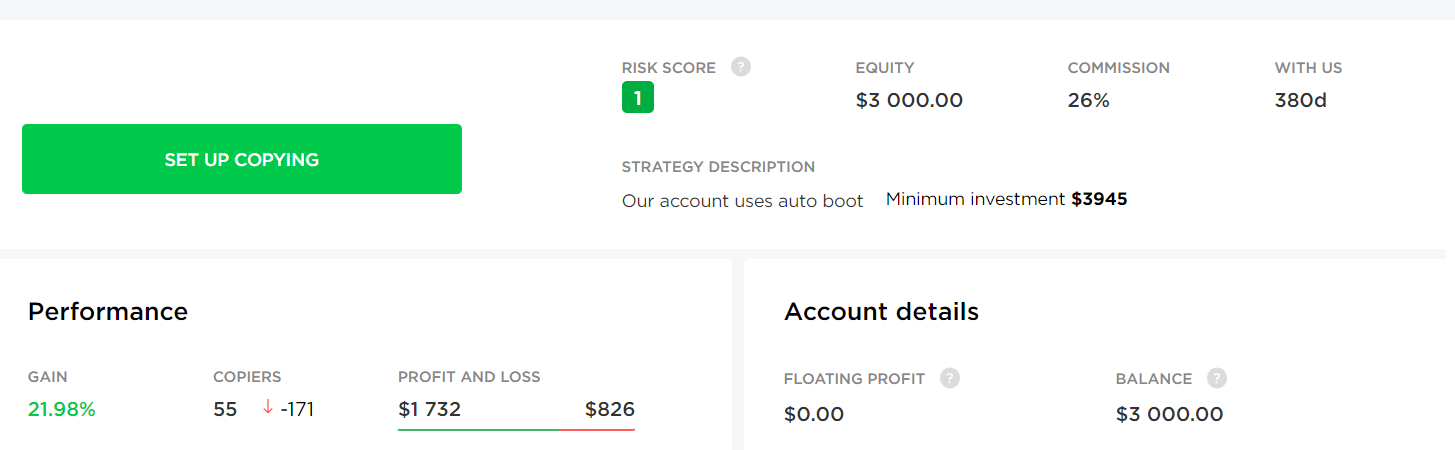

The below screenshot is an example of the basic metrics which the broker will show on their platform.

These will normally include overall AUM managed, probability of profits, success rates, and historical trades.

All the metrics listed should be carefully checked and compared. Only the best suited trader should be chosen to be copied after you have done your due diligence & understood the risks. Multiple traders can also be copied to diversify the copy trading portfolio.

It is important to know that there are many risk associated with copy trading, including the risk that you can lose your capital if you risk too much & the trader who you are following has bad trades. There is no guarantee that you will make money with copy trading, and many retail traders still lose their money.

Also, another important factor to understand is that the instruments offered by brokers are CFDs. So you don’t own any underlying asset & are only speculating whether the price of that asset will go down or up.

Assuming that the trader you are following is right, and you copied that trade, you would make a profit (minus commissions). But if the trad that you copied is a losing trade, then you will make a loss.

You must fully understand the strategy of the trader you are following before you decide to copy their trade(s). If you don’t understand the reasons for taking a trade, and are copying it without any research, then it is likely that you will lose. Although, even if you do understand the reasons for a trade, it does not guarantee that you will make a profit, but it is help you understand & weigh the risks before copying any trade.

Copy Trading allows beginner traders to copy the trades of other traders on a broker’s platform. Most Forex brokers that offer copy trading have features where you can check the performance & risk levels of the traders that you can copy.

It is not illegal to use copy trading brokers in Nigeria because as such, there is no rule against these brokers by the local regulators. But since forex trading is not yet regulated in Nigeria, so traders are trading at their own risk. You must only trade via brokers that are regulated with multiple top-tier regulators including FCA, CySEC & ASIC. This way, you can have some safety that the broker is not a scam.

Also do your due diligence on the traders that you are looking to follow. This is because depending on the master trader’s strategies, your risk, drawdowns could be very large.

You can open copy trading account in 3 steps.

Choose a broker that is regulated with Top-tier regulation like FCA, FSCA or ASIC.

Signup with the broker & open your Live Trading account by completing the KYC verification.

Check the performance of other copy traders available & start copying their trades.