Fundamental Analysis

In fundamental analysis, you look at the events that will have an impact on the world. On of the most important factor for example is the 'Interest Rates'. Let's understand it,

Interest Rate differentials can cause high volatility in the Forex Market. For example, during 2022, the Federal Reserve in the US had to tighten their monetary policy to control high inflation. And they were the first major Central Bank to tighten ahead of the ECB, BoJ & BoE. This has caused the US Dollar to rise sharply against the EUR, JPY, GBP & other major currencies in 2022.

In Macro, at the start of 2023, when all the other Central banks, like the ECB & BoJ are also going into their tightening cycle by increasing interest rates (and also QT in case of ECB), this reduces the interest rate differentials between the US & European Central Banks. This causes the Dollar Index to be more stable.

Another major reason for the appreciation in US Dollar is the Risk Off global crisis (or Deflation). During such events like the GFC in 2007 or Covid crisis & risk off in the markets at the start of 2020, all the capital in the world flows to US Dollar from other assets, and this causes the USD to rise against almost all other Fiat Currencies. So, during this period, you will see the USD Dollar rise against all the other major currencies.

The cyclical currencies of major commodity exporters like AUD, ZAR, CAD, BRL etc. are most affected during such events of Risk off & growth Slowdown as the commodity prices are dropping. On the other hand, these currencies do well during inflationary cycles.

Understading what moves which currency pairs can help you understand which currency should you trade in which part of the cycle. For example, the Australian Dollar can be affected by the Slowdown in China, as AUD is generally a commodity currency. In general, Commodity currencies do well during risk on events or global economic upturn, so that is the period when you should hold these currencies.

Technical Analysis

Most technical forex trading strategies involve some level of study and analyse of the chart or trend patterns of the currencies before making an actual trade. Good thing is that almost all brokers around the world now offer MT4 or MT5, which are excellent platforms for sound technical analysis. There are also many popular Third-party platforms like Tradingview, which is also good for data & analyzing charts.

Advise: Building an understanding of the current market scenario & having a working strategy before placing a live trade is highly recommended. Only based on your strategy, you can make actually get the best returns in the future.

For example, if you are have a view that the Global economy is going to grow, then you should use technical analysis to find best Risk Reward entry into currencies that do well during growth cycles. Similarly, if you have a view that the growth is going to slow down, then you should use technical analysis to find entries with 1:5 Risk/Reward for trading that view.

Depending on how you are as a trader, you should hold your position for intraday, or for few weeks. You should develop your own techniques based in your market views & use technical analysis to time the trades.

Now let's look into some of the most popular forex trading strategies.

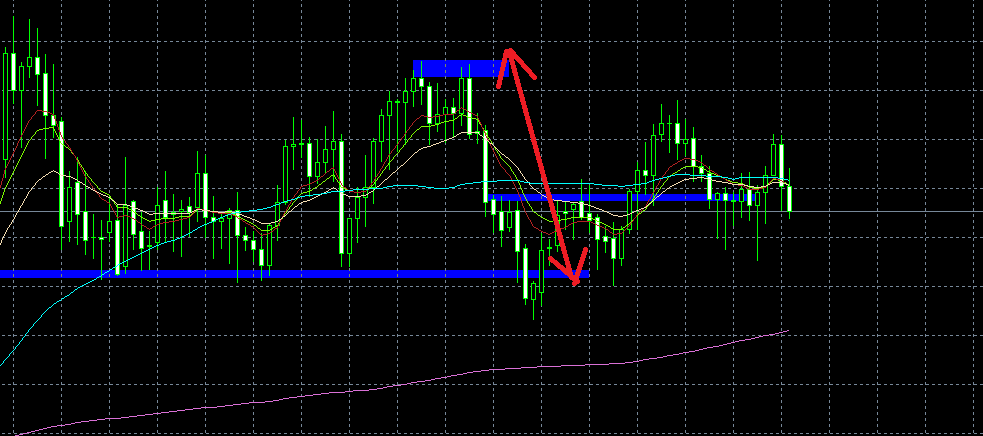

1) Trend Trading or Support & Resistance trading

In theory, trend trading involves identifying a trend, waiting for the pullback in price & then following the continuation wave. This is one of the most profitable trading strategy in a trending market & was also the main strategy for highly successful traders like Jesse Livermore.

But identifying the underlying trend is most important. You can simply use 200 Day Moving average to identify the Long to Medium term trend. If the price goes below this Long term average, then you should exit your Long positions.

You can also use simple Oscilator indicators like RSI to identify Overbought or Oversold conditions to exit your entries.

Let's say the high for EUR/USD for the last 3 months is 1.31 (making it a price level of importance). We call the high the resistance. Do note that this is just a hypothetical example & not real resistance on EURUSD chart.

There can be resistance levels on lower time frames as well, but we will use a higher time frame to find important levels for positional trends.

Once the price crosses the previous high to achieve a higher high (price crosses 1.31 in this example), there is a huge chance that the old high will become the new low in a trending market. The low is now called the support.

Stick to the Majors: In the current scenario, there are seven major currency pairs which constitute almost 80% of the transactions. These major pairs include USD/EUR, USD/GBP, USD/JPY, USD/CHF, USD/AUD, USD/CAD, and USD/NZD.

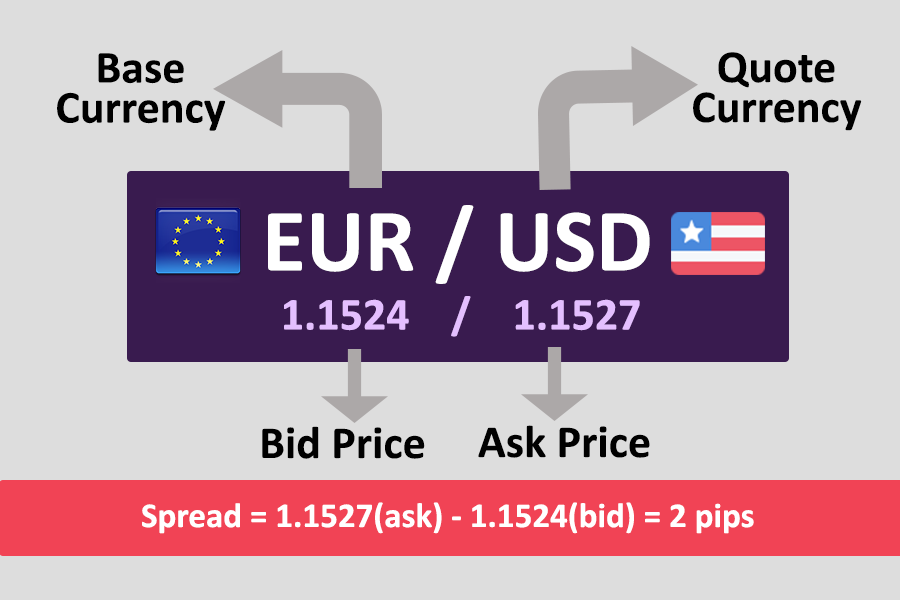

If you are a new investor, it is a good strategy to begin trend trading on one of these pairs. This is because these pairs are very liquid, have low spreads and have stable volatility. Since these currencies are stable in their movements, they will help you in managing your risk initially (by reducing volatility against your direction). It is always a good strategy, to begin with, a USD pair because of stability. There are various other pairings available which do not include the USD.

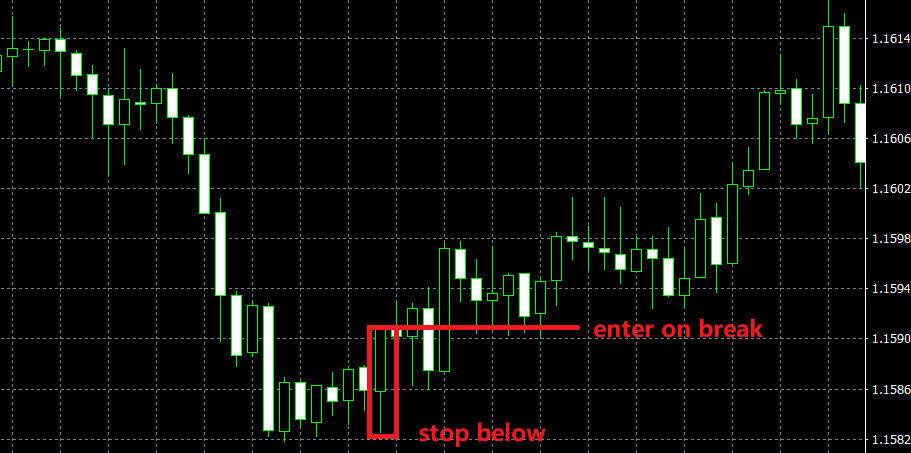

2) Price Action Trading

This is one of the strategies that many traders use. Under this trading strategy, you look for specific price actions on currency pairs & only trade those.

For example, one popular price action is 'Engulfing' bars. It can be bullish or bearish engulfing, depending on the setup.

But price action in isolation would have lower chances of success. If you use price action in confluence with the 'location', then the chances of each trade working are much higher.

Below is an example, of Bullish engulfing on USD/JPY on a key location, which is the 50% fib retracement of the last swing, and a key demand zone. The chances of it working were higher, but that does not mean it would definitely work.

To trade engulfing, you place the stop few pips above/below the high/low. Adjust your position size based on the risk & pips you need to risk for this stop loss.

Note that for any trading strategy to be successful, you need to see the outcome over a 'series of trades'. By this, I mean a single trade can or may not work.

For example, if you are are long USD/CAD based on an intraday price action like Bullish Engulfing on 15 minute, near an important support level on the daily, then your changes of success are high. But that does not mean the trade will definitely be profitable, you could get stopped out.

Therefore, you must understand that a single trade you take could be a loser. But what matters is your risk reward, and win percentage over a series of similar trades.